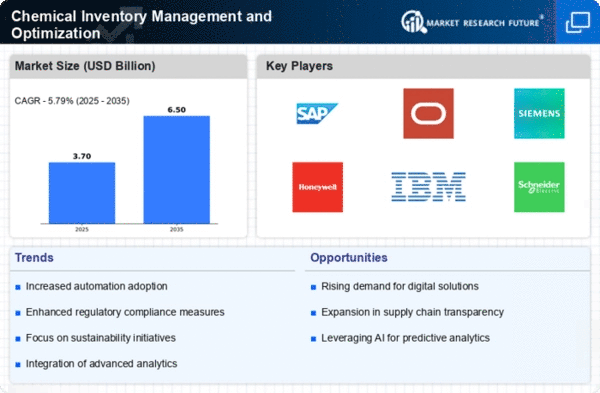

The Chemical Inventory Management and Optimization market is characterized by a dynamic competitive landscape, driven by the increasing need for efficiency and compliance in chemical handling. Key players such as SAP (DE), Oracle (US), and Honeywell (US) are at the forefront, each adopting distinct strategies to enhance their market positioning. SAP (DE) focuses on integrating advanced analytics and cloud solutions to streamline inventory processes, while Oracle (US) emphasizes its robust ERP systems to facilitate real-time data access and decision-making. Honeywell (US), on the other hand, is leveraging its expertise in automation and IoT to optimize chemical management systems, thereby enhancing operational efficiency and safety. Collectively, these strategies indicate a trend towards digital transformation and innovation, shaping a competitive environment that prioritizes technological advancement and operational excellence.In terms of business tactics, companies are increasingly localizing manufacturing and optimizing supply chains to respond swiftly to market demands. The market structure appears moderately fragmented, with several players vying for dominance. However, the collective influence of major companies like Siemens (DE) and IBM (US) is notable, as they continue to expand their offerings and capabilities, thereby intensifying competition. This competitive structure suggests that while there are numerous players, the strategic maneuvers of key companies significantly impact market dynamics.

In November Siemens (DE) announced a strategic partnership with a leading AI firm to enhance its chemical inventory management solutions. This collaboration aims to integrate AI-driven predictive analytics into Siemens' existing platforms, potentially revolutionizing how companies forecast chemical needs and manage inventory levels. The strategic importance of this move lies in its potential to provide clients with unprecedented insights, thereby improving efficiency and reducing waste in chemical management processes.

In October IBM (US) launched a new blockchain-based solution designed to enhance transparency and traceability in chemical supply chains. This initiative is particularly significant as it addresses growing regulatory pressures and the demand for sustainable practices in the industry. By leveraging blockchain technology, IBM (US) aims to provide clients with a secure and immutable record of chemical transactions, which could enhance trust and compliance across the supply chain.

In September Honeywell (US) unveiled an innovative cloud-based platform that integrates IoT capabilities for real-time monitoring of chemical inventories. This platform is expected to empower companies to optimize their inventory levels dynamically, reducing costs and improving safety. The strategic importance of this development is underscored by the increasing demand for real-time data in inventory management, which is becoming a critical factor for operational success in the chemical sector.

As of December current competitive trends in the Chemical Inventory Management and Optimization market are heavily influenced by digitalization, sustainability, and AI integration. Strategic alliances are increasingly shaping the landscape, as companies recognize the value of collaboration in driving innovation. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on technological innovation, supply chain reliability, and sustainability initiatives. This shift suggests that companies that prioritize these aspects will be better positioned to thrive in an increasingly complex market.