North America : Market Leader in Optimization Services

North America is poised to maintain its leadership in the Chemical Operations Optimization Services Market, holding a market size of $2.75B in 2025. Key growth drivers include technological advancements, increased demand for efficiency, and stringent regulatory frameworks aimed at sustainability. The region's focus on innovation and digital transformation is further propelling market expansion, with companies investing heavily in automation and data analytics to enhance operational efficiency.

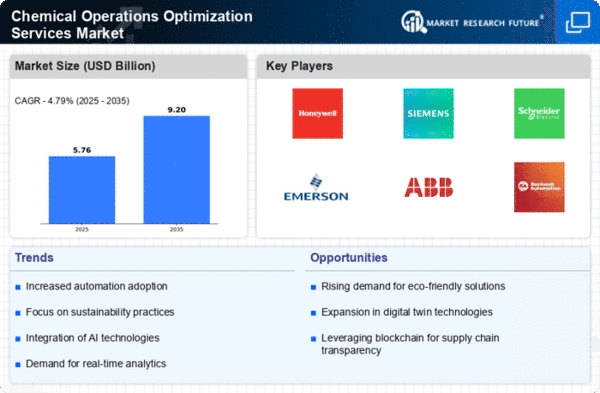

The competitive landscape is robust, featuring major players such as Honeywell, Emerson Electric, and Rockwell Automation. The U.S. stands out as the leading country, driven by its advanced industrial base and significant investments in R&D. The presence of established firms and a growing number of startups in the optimization services sector is fostering a dynamic environment, ensuring that North America remains at the forefront of market developments.

Europe : Emerging Hub for Innovation

Europe is emerging as a significant player in the Chemical Operations Optimization Services Market, with a market size of $1.5B projected for 2025. The region benefits from a strong regulatory environment that promotes sustainability and efficiency, driving demand for optimization services. Initiatives aimed at reducing carbon emissions and enhancing operational efficiency are key catalysts for growth, as industries seek to comply with stringent EU regulations and standards.

Leading countries such as Germany, France, and the UK are at the forefront of this market, supported by major players like Siemens and Schneider Electric. The competitive landscape is characterized by a mix of established firms and innovative startups, fostering collaboration and technological advancements. The European market is increasingly focused on integrating AI and IoT technologies to enhance service offerings and operational capabilities.

Asia-Pacific : Rapidly Growing Market Potential

Asia-Pacific is witnessing rapid growth in the Chemical Operations Optimization Services Market, with a projected size of $1.2B by 2025. The region's growth is driven by increasing industrialization, rising demand for energy efficiency, and government initiatives aimed at enhancing operational performance. Countries like China and India are investing heavily in modernization and automation, creating a favorable environment for optimization services to thrive.

China leads the market, supported by significant investments in technology and infrastructure. The competitive landscape includes both global players and local firms, with companies like ABB and Emerson Electric establishing a strong presence. The region's focus on digital transformation and smart manufacturing is expected to further accelerate market growth, positioning Asia-Pacific as a key player in the global optimization services landscape.

Middle East and Africa : Emerging Market with Challenges

The Middle East and Africa region is in the nascent stages of developing its Chemical Operations Optimization Services Market, with a market size of $0.05B projected for 2025. The growth is primarily driven by increasing investments in the oil and gas sector, coupled with a growing emphasis on operational efficiency and sustainability. However, challenges such as political instability and economic fluctuations may hinder rapid market development.

Countries like Saudi Arabia and South Africa are leading the charge, focusing on modernization and technological adoption in their industrial sectors. The competitive landscape is still evolving, with a mix of local and international players beginning to establish their foothold. As the region continues to invest in infrastructure and technology, opportunities for optimization services are expected to grow, albeit at a slower pace compared to other regions.