North America : Innovation and Leadership Hub

North America continues to lead the global market for Chemical Process Design and Optimization, holding a significant market share of 6.0 in 2024. The region's growth is driven by robust demand for advanced technologies, increased investment in R&D, and stringent regulatory frameworks promoting sustainability. The push for digital transformation and automation in manufacturing processes further fuels market expansion, making it a key player in the global landscape.

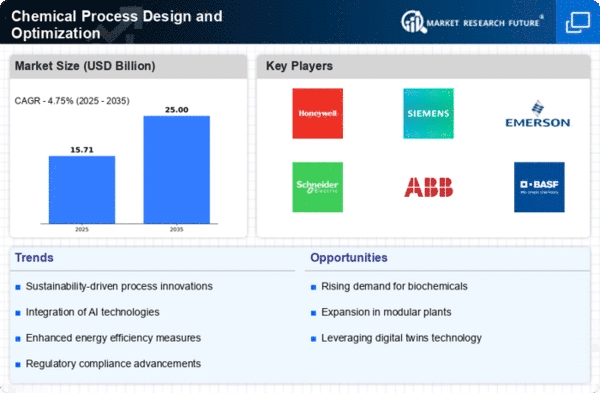

The competitive landscape in North America is characterized by the presence of major players such as Honeywell, Emerson Electric, and DuPont. These companies are at the forefront of innovation, leveraging cutting-edge technologies to enhance efficiency and reduce costs. The U.S. remains the leading country, supported by favorable government policies and a strong industrial base, while Canada and Mexico also contribute to the region's growth through strategic partnerships and investments.

Europe : Sustainability and Innovation Focus

Europe's market for Chemical Process Design and Optimization is projected at 4.5, reflecting a strong commitment to sustainability and innovation. The region is witnessing a surge in demand for eco-friendly processes and technologies, driven by stringent EU regulations aimed at reducing carbon emissions. This regulatory environment acts as a catalyst for companies to adopt advanced optimization techniques, enhancing operational efficiency and compliance with environmental standards.

Leading countries in Europe include Germany, France, and the UK, where companies like Siemens and BASF are making significant strides in process optimization. The competitive landscape is marked by collaboration between industry players and research institutions, fostering innovation. The European market is characterized by a diverse range of solutions tailored to meet the unique needs of various sectors, ensuring a robust growth trajectory.

Asia-Pacific : Rapid Growth and Development

The Asia-Pacific region, with a market size of 3.5, is rapidly emerging as a powerhouse in Chemical Process Design and Optimization. The growth is fueled by increasing industrialization, urbanization, and a rising demand for energy-efficient solutions. Governments in countries like China and India are implementing policies to promote sustainable practices, which is driving the adoption of advanced chemical processes and technologies across various industries.

China stands out as a leading country in this region, with significant investments in chemical manufacturing and optimization technologies. The competitive landscape is evolving, with both local and international players vying for market share. Companies are focusing on innovation and collaboration to enhance their offerings, ensuring they meet the growing demand for efficient and sustainable chemical processes in the region.

Middle East and Africa : Resource-Rich and Emerging Market

The Middle East and Africa region, with a market size of 1.0, presents significant growth potential in Chemical Process Design and Optimization. The region is rich in natural resources, particularly oil and gas, which drives demand for efficient chemical processes. Governments are increasingly recognizing the importance of optimizing these processes to enhance productivity and sustainability, leading to favorable regulatory frameworks that encourage investment in advanced technologies.

Countries like Saudi Arabia and South Africa are at the forefront of this growth, with initiatives aimed at diversifying their economies and investing in chemical manufacturing. The competitive landscape is characterized by a mix of established players and emerging companies, all striving to capitalize on the region's vast resources and growing market demand for optimized chemical processes.