Research Methodology on CBD Skincare Products Market

Market Research Future (MRFR) employs a comprehensive research methodology to prepare and analyze the CBD Skincare Products market for 2024-2032. It includes extensive primary and secondary research. Primary research involves collecting data directly from industry participants, opinion leaders, and authorities through interviews, surveys, and more. Secondary research is the compilation of data from magazines, news articles, websites, and other published sources.

MRFR also collects data from both primary and secondary sources and then verifies the accuracy of the data before entering it into the research reports. The information collected is then filtered and evaluated through statistical tools and market modelling, resulting in a comprehensive and accurate forecast of the CBD Skincare Products market for the forecast period. Furthermore, special attention is given to the impact of Covid-19 and its probability of fostering or inhibiting the CBD Skincare Products market growth.

Market Definition

The CBD Skincare Products market is for topical solutions containing active compounds from Cannabis sativa. These topical solutions are available in the form of creams, lotions, oils, and serums, among others. These products are specifically formulated for soothing, cleansing, moisturizing, and antibacterial effects on the skin. The active compounds in CBD skincare products interact with the endocannabinoid receptors in the skin, producing calming, regenerative, and anti-inflammatory effects. Currently, the CBD skincare products market is experiencing rapid growth, courtesy of their relatively safe backing and the presence of a wide range of product options.

Market Segmentation

The CBD Skincare Products market is divided into product type, end-user, and region to facilitate a comprehensive analysis.

Based on product type, the CBD Skincare Products market is segmented into creams & lotions, oils, serums, masks & face packs, and others. The creams & lotions segment will likely account for a considerable portion of the market in the coming years.

Based on the end user, the CBD Skincare Products market is segmented into homecare, hospitals, clinics & spas, and others.

Regional Analysis

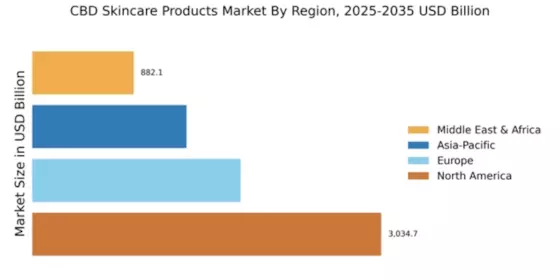

The CBD Skincare Products market encompasses four major regions: North America, Europe, Asia-Pacific, and the Rest of the World.

North America is likely to dominate the market during the forecast period because of high disposable income, the presence of key manufacturers, increasing demand for beauty and personal care products, and the growing acceptance of vegan and cruelty-free products in the region.

The Europe CBD Skincare Products market is the second-largest and is likely to experience steady growth during the forecast period. Key drivers of the market in the region include increasing disposable income, rising awareness of the potential health and skincare benefits, and the surge of celebrities who use CBD skincare products.

The Asia-Pacific CBD Skincare Products market is likely to witness significant growth during the forecast period. The market's growth can be attributed to the growing demand for natural and organic beauty and skincare products, the surge in the publicity of the health and skincare benefits of CBD skincare products, and increasing disposable income.