Enhanced Security Features

Security concerns are paramount in the Cash Recycling Module Market, driving the adoption of advanced cash recycling solutions. With increasing incidents of theft and fraud, financial institutions are prioritizing systems that offer enhanced security features. Modern cash recycling modules are equipped with sophisticated technologies such as biometric authentication and real-time monitoring, which significantly mitigate risks. Data suggests that the implementation of these security measures can reduce cash-related losses by up to 40%. As organizations strive to protect their assets and maintain customer trust, the demand for secure cash recycling solutions is likely to escalate, further fueling the growth of the Cash Recycling Module Market.

Increased Demand for Automation

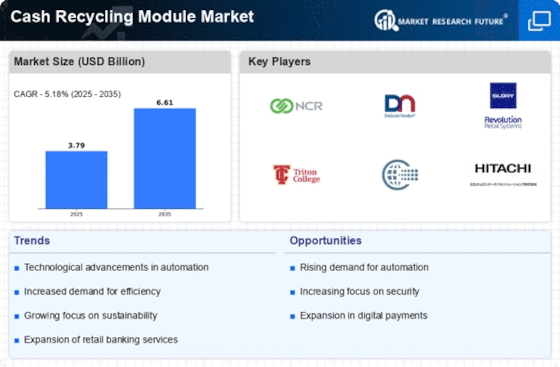

The Cash Recycling Module Market experiences a notable surge in demand for automation solutions. As financial institutions and retail sectors strive to enhance operational efficiency, the integration of cash recycling modules becomes increasingly appealing. These systems streamline cash handling processes, reduce human error, and minimize labor costs. According to recent data, the automation trend is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This growth is driven by the need for faster transaction processing and improved customer service. Consequently, the Cash Recycling Module Market is likely to witness a robust expansion as businesses seek to adopt these advanced technologies.

Rising Focus on Cost Efficiency

Cost efficiency remains a pivotal driver in the Cash Recycling Module Market. Organizations are continually seeking ways to optimize their cash management processes, and cash recycling modules offer a viable solution. By automating cash handling, businesses can significantly reduce operational costs associated with manual cash management. Reports indicate that companies utilizing cash recycling systems can achieve up to a 30% reduction in cash handling costs. This financial incentive encourages more entities to invest in cash recycling technology, thereby propelling the growth of the Cash Recycling Module Market. As the emphasis on cost reduction intensifies, the adoption of these systems is expected to rise.

Regulatory Compliance Requirements

The Cash Recycling Module Market is influenced by stringent regulatory compliance requirements imposed on financial institutions. Governments and regulatory bodies are increasingly mandating that organizations adhere to specific cash handling and reporting standards. This regulatory landscape compels businesses to invest in cash recycling modules that not only streamline operations but also ensure compliance with legal requirements. Failure to comply can result in substantial fines and reputational damage. Consequently, the demand for cash recycling solutions that facilitate compliance is expected to rise, thereby driving growth in the Cash Recycling Module Market. Organizations are likely to prioritize systems that simplify adherence to these regulations.

Shift Towards Contactless Transactions

The Cash Recycling Module Market is witnessing a shift towards contactless transactions, which is reshaping cash handling practices. As consumers increasingly prefer contactless payment methods, businesses are adapting their cash management strategies accordingly. Cash recycling modules that support contactless transactions are becoming essential for retailers and financial institutions aiming to meet customer expectations. This trend is supported by data indicating that contactless payments are projected to account for over 50% of all transactions in the coming years. As the demand for seamless and efficient payment solutions grows, the Cash Recycling Module Market is likely to benefit from the integration of contactless technology into cash recycling systems.