Advancements in Biotechnology

Technological advancements in biotechnology are propelling the CAS9 Technology Market forward. Innovations in CRISPR technology, particularly the refinement of CAS9 systems, have enhanced the efficiency and accuracy of gene editing processes. These advancements are not only improving research outcomes but also facilitating the development of new therapeutic applications. For instance, the integration of CAS9 technology in gene therapies has shown promise in treating genetic disorders, which could potentially lead to a market valuation exceeding USD 8 billion by 2025. Furthermore, the ongoing research into next-generation CAS9 variants is expected to broaden the scope of applications, thereby driving further growth in the CAS9 Technology Market.

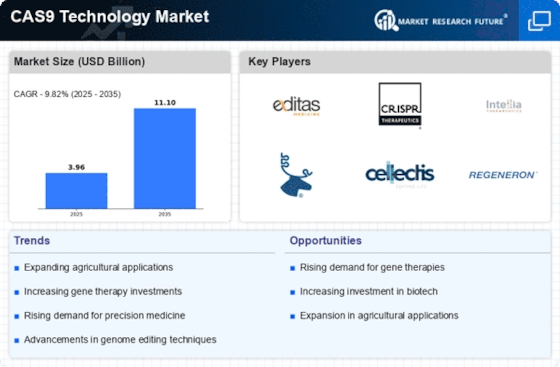

Rising Demand for Gene Editing Solutions

The CAS9 Technology Market is experiencing a notable surge in demand for gene editing solutions across various sectors, including healthcare and agriculture. This demand is primarily driven by the increasing prevalence of genetic disorders and the need for innovative treatments. According to recent estimates, the gene editing market is projected to reach USD 10 billion by 2026, with CAS9 technology playing a pivotal role in this growth. The ability of CAS9 to precisely edit genes offers unprecedented opportunities for developing therapies that can address previously untreatable conditions. As researchers and companies continue to explore the potential of gene editing, the CAS9 Technology Market is likely to expand significantly, attracting investments and fostering collaborations aimed at advancing genetic research.

Growing Investment in Personalized Medicine

The CAS9 Technology Market is significantly influenced by the growing investment in personalized medicine. As healthcare shifts towards more individualized treatment approaches, the demand for precise gene editing tools like CAS9 is increasing. Personalized medicine aims to tailor treatments based on a patient's genetic makeup, which necessitates advanced technologies for effective implementation. The market for personalized medicine is expected to reach USD 2 trillion by 2030, with CAS9 technology being a critical component in developing targeted therapies. This trend indicates a robust future for the CAS9 Technology Market, as stakeholders recognize the potential of gene editing to revolutionize treatment paradigms and improve patient outcomes.

Increased Focus on Agricultural Biotechnology

The CAS9 Technology Market is witnessing a significant increase in focus on agricultural biotechnology, driven by the need for sustainable food production. As the global population continues to rise, the demand for genetically modified crops that can withstand environmental stresses is becoming more pressing. CAS9 technology enables precise modifications in crop genomes, enhancing traits such as yield, pest resistance, and nutritional value. Reports indicate that the agricultural biotechnology market is projected to grow at a CAGR of 10% through 2025, with CAS9 technology at the forefront of this transformation. This trend not only supports food security but also aligns with environmental sustainability goals, further solidifying the role of CAS9 technology in the agricultural sector.

Regulatory Support for Gene Editing Technologies

The CAS9 Technology Market is benefiting from increasing regulatory support for gene editing technologies. Governments and regulatory bodies are beginning to establish frameworks that facilitate the development and commercialization of gene editing products. This support is crucial for fostering innovation and ensuring that new therapies can reach the market efficiently. For instance, recent policy changes in several regions have streamlined the approval processes for genetically modified organisms, which is likely to enhance the adoption of CAS9 technology in various applications. As regulatory environments become more favorable, the CAS9 Technology Market is expected to experience accelerated growth, attracting investments and encouraging research initiatives aimed at harnessing the full potential of gene editing.