Government Support and Funding

Government initiatives in Canada are playing a crucial role in the growth of the cas9 technology market. The Canadian government has recognized the potential of gene editing technologies and has allocated substantial funding to support research and development in this area. In recent years, funding for biotechnology research has increased by over 20%, indicating a strong commitment to fostering innovation. This financial backing not only aids academic institutions but also encourages private sector participation, leading to collaborative projects that enhance the capabilities of cas9 technology. Additionally, favorable policies and grants aimed at promoting biotechnology research are likely to attract more players into the market, thereby stimulating growth and innovation in the cas9 technology market.

Expanding Applications in Agriculture

The cas9 technology market is witnessing an expansion in its applications within the agricultural sector in Canada. With the growing need for sustainable farming practices and food security, gene editing technologies are being utilized to develop crops that are more resilient to pests, diseases, and climate change. The market for genetically modified crops is projected to reach $5 billion by 2027, underscoring the role of cas9 technology in enhancing agricultural productivity. Furthermore, the ability to create crops with improved nutritional profiles is gaining traction among consumers, leading to increased acceptance of genetically modified organisms. This trend suggests that the agricultural applications of cas9 technology could become a major driver of market growth, as stakeholders seek to address the challenges posed by a growing population and changing environmental conditions.

Rising Demand for Gene Editing Solutions

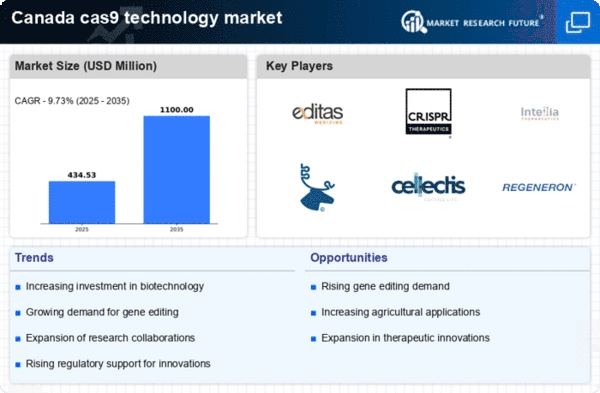

The demand for gene editing solutions in Canada is surging. This demand is primarily driven by advancements in genetic research and the increasing application of CRISPR technology in various fields, including agriculture, medicine, and industrial biotechnology. As of 2025, the market is projected to grow at a CAGR of approximately 15%, reflecting the growing interest in precision medicine and genetically modified organisms. The ability of cas9 technology to facilitate targeted modifications in DNA sequences is appealing to researchers and companies alike, leading to increased investments in R&D. Furthermore, the rising prevalence of genetic disorders and the need for innovative therapies are likely to further propel the market, making it a pivotal area of focus for stakeholders in the biotechnology sector.

Increasing Public Awareness and Acceptance

Public awareness and acceptance of gene editing technologies are gradually increasing in Canada, which is positively impacting the cas9 technology market. As educational initiatives and media coverage highlight the benefits of gene editing, more individuals are becoming informed about its potential applications in medicine and agriculture. Surveys indicate that approximately 60% of Canadians are now supportive of genetically modified crops, reflecting a shift in public perception. This growing acceptance is likely to encourage investment and research in the cas9 technology market, as companies seek to align their products with consumer preferences. Moreover, as ethical discussions surrounding gene editing evolve, the market may see a rise in demand for transparent and responsible applications of cas9 technology, further driving its growth.

Technological Advancements and Innovations

Technological advancements are significantly influencing the cas9 technology market in Canada. Continuous innovations in CRISPR technology are enhancing the efficiency and accuracy of gene editing processes, making them more accessible to researchers and companies. The introduction of next-generation sequencing and improved delivery methods for cas9 components are examples of innovations that are likely to streamline workflows and reduce costs. As of November 2025, the market is expected to benefit from these advancements, with a projected increase in the number of applications across various sectors, including healthcare and agriculture. The ongoing research into novel cas9 variants and their potential applications may further diversify the market, creating new opportunities for growth and development in the cas9 technology market.