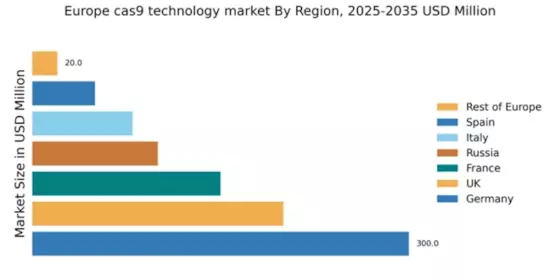

Germany : Strong Innovation and Investment Climate

Germany holds a dominant position in the European cas9 technology market, accounting for 37.5% with a market value of $300.0 million. Key growth drivers include robust R&D investments, a strong biotech ecosystem, and supportive government policies promoting gene editing technologies. The demand for cas9 applications in agriculture and healthcare is rising, driven by advancements in personalized medicine and agricultural biotechnology. Regulatory frameworks are evolving to facilitate innovation while ensuring safety and efficacy.

UK : Strong Academic and Industrial Collaboration

The UK represents 25% of the European cas9 market, valued at $200.0 million. The growth is fueled by strong academic institutions collaborating with biotech firms, leading to innovative applications in healthcare and agriculture. The UK government has initiated policies to streamline the regulatory process for gene editing, enhancing market accessibility. The demand for precision medicine and sustainable agricultural solutions is driving consumption patterns in this sub-region.

France : Government Support and Research Initiatives

France captures 18.75% of the cas9 market, valued at $150.0 million. The growth is supported by government initiatives aimed at fostering biotech innovation and research. Demand for cas9 technology is increasing in therapeutic applications, particularly in genetic disorders. The French regulatory landscape is adapting to accommodate advancements in gene editing, ensuring compliance while promoting innovation. The presence of research institutions and biotech firms is pivotal in driving market growth.

Russia : Expanding Biotech Sector Opportunities

Russia holds a 12.5% share of the cas9 market, valued at $100.0 million. The growth is driven by increasing investments in biotechnology and a rising interest in genetic research. Demand for cas9 technology is emerging in agriculture and healthcare sectors, supported by government initiatives to enhance research capabilities. The regulatory environment is evolving, aiming to balance innovation with safety standards, fostering a conducive business environment for biotech firms.

Italy : Focus on Agricultural Applications

Italy accounts for 10% of the cas9 market, valued at $80.0 million. The growth is primarily driven by the agricultural sector, where cas9 technology is being utilized for crop improvement and pest resistance. Government policies are increasingly supportive of biotech innovations, promoting research and development. The competitive landscape includes several local biotech firms and collaborations with academic institutions, enhancing the market's dynamism and innovation.

Spain : Investment in Research and Development

Spain represents 6.25% of the cas9 market, valued at $50.0 million. The growth is supported by increasing investments in biotech research and a focus on agricultural applications. Demand for cas9 technology is rising, particularly in crop enhancement and healthcare solutions. The Spanish government is implementing policies to support biotech innovation, creating a favorable environment for market growth. Local firms are increasingly collaborating with international players to enhance their capabilities.

Rest of Europe : Varied Market Dynamics Across Regions

The Rest of Europe accounts for 2.5% of the cas9 market, valued at $20.0 million. This sub-region showcases diverse market dynamics, with varying levels of investment and regulatory support across countries. Demand for cas9 technology is emerging in niche applications, particularly in healthcare and agriculture. The competitive landscape is fragmented, with local players and collaborations driving innovation. Government initiatives are gradually enhancing the biotech ecosystem, fostering growth opportunities.