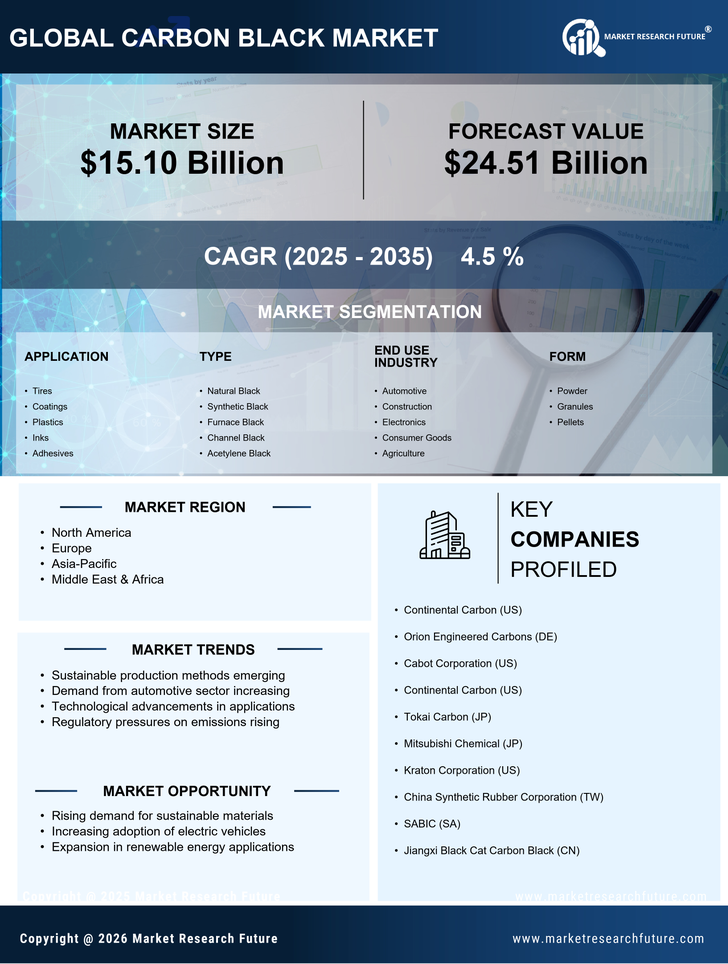

Rising Environmental Regulations

The Carbon Black Market is influenced by the increasing stringency of environmental regulations aimed at reducing emissions and promoting sustainable practices. Governments are implementing policies that encourage the use of eco-friendly materials and processes, which may impact the production methods of carbon black. Manufacturers are likely to invest in cleaner technologies and alternative feedstocks to comply with these regulations. This shift could lead to a transformation in the Carbon Black Market, as companies adapt to meet regulatory requirements while maintaining product quality. The emphasis on sustainability may also open new avenues for innovation within the industry.

Growth in Tire Recycling Initiatives

The rise of tire recycling initiatives is emerging as a crucial driver for the Carbon Black Market. As the focus on sustainability intensifies, the recycling of used tires into carbon black is gaining traction. This process not only reduces waste but also provides a sustainable source of carbon black for various applications. In 2025, it is anticipated that recycled carbon black could account for a growing percentage of the market, potentially reaching 10% of total carbon black consumption. This trend indicates a shift towards circular economy practices within the Carbon Black Market, fostering innovation and sustainability.

Expansion of the Construction Industry

The construction industry plays a pivotal role in driving the Carbon Black Market, particularly through the use of carbon black in various construction materials. Carbon black is utilized in the production of asphalt, coatings, and sealants, enhancing durability and performance. As urbanization accelerates and infrastructure projects expand, the demand for construction materials incorporating carbon black is likely to increase. In 2025, the construction sector is expected to account for a notable share of carbon black consumption, potentially reaching 15% of the overall market. This growth reflects the industry's reliance on carbon black to improve material properties and longevity.

Technological Innovations in Production

Technological advancements in the production of carbon black are significantly shaping the Carbon Black Market. Innovations such as the development of more efficient manufacturing processes and the introduction of alternative production methods are enhancing the quality and reducing the costs of carbon black. For instance, the adoption of advanced reactor designs and process optimization techniques may lead to higher yields and lower energy consumption. As these technologies become more prevalent, they could potentially increase the competitiveness of the Carbon Black Market, allowing manufacturers to meet growing demand while improving profitability.

Increasing Demand from Automotive Sector

The automotive sector is a primary driver for the Carbon Black Market, as carbon black is extensively used in tire manufacturing and other rubber products. The demand for high-performance tires, which require specific grades of carbon black, is on the rise due to the increasing focus on vehicle safety and performance. In 2025, the automotive industry is projected to consume a significant portion of the carbon black produced, with estimates suggesting that around 60% of the total carbon black demand may stem from this sector. This trend indicates a robust growth trajectory for the Carbon Black Market, as manufacturers strive to meet the evolving needs of automotive applications.