Rising Air Pollution Levels

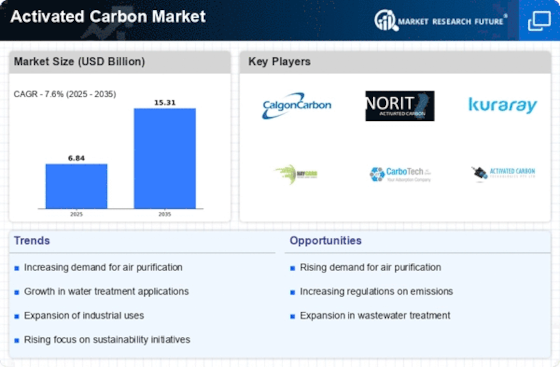

The Activated Carbon Market is significantly influenced by the rising levels of air pollution across various regions. Activated carbon is extensively utilized in air purification systems to capture volatile organic compounds, odors, and harmful gases. With urbanization and industrial activities contributing to deteriorating air quality, there is an increasing emphasis on air pollution control measures. The market data suggests that the air treatment segment is expected to grow at a compound annual growth rate of over 6% through 2027. This growth is likely fueled by both regulatory pressures and public awareness regarding health impacts associated with poor air quality. As a result, the activated carbon market is poised to expand, driven by the urgent need for effective air filtration solutions.

Increasing Demand for Water Treatment

The Activated Carbon Market is experiencing a notable surge in demand for water treatment applications. Activated carbon is widely recognized for its efficacy in removing contaminants, including chlorine, heavy metals, and organic compounds from water. As water quality concerns escalate, municipalities and industries are increasingly investing in advanced water treatment technologies. According to recent data, the water treatment segment is projected to account for a substantial share of the activated carbon market, potentially exceeding 40% by 2026. This trend is driven by the need for safe drinking water and the implementation of stringent regulations regarding water quality. Consequently, the activated carbon market is likely to witness robust growth as more entities prioritize sustainable water management solutions.

Growing Awareness of Environmental Sustainability

The Activated Carbon Market is increasingly driven by a growing awareness of environmental sustainability among consumers and businesses alike. As organizations strive to reduce their carbon footprint and adopt eco-friendly practices, activated carbon emerges as a viable solution for various applications, including waste management and pollution control. Market data indicates that the demand for sustainable products is on the rise, with activated carbon being recognized for its renewable and recyclable properties. This trend is likely to propel the activated carbon market forward, as more companies seek to align their operations with sustainability goals. The emphasis on environmental responsibility is expected to create new avenues for growth within the activated carbon sector.

Technological Innovations in Production Processes

The Activated Carbon Market is witnessing a wave of technological innovations that enhance production processes and improve product quality. Advances in manufacturing techniques, such as the development of more efficient activation methods, are enabling producers to create activated carbon with superior adsorption capabilities. This is particularly relevant in applications requiring high-performance materials, such as air and water treatment. Market analysis suggests that these innovations could lead to a reduction in production costs and an increase in the availability of high-quality activated carbon. As a result, the activated carbon market is likely to benefit from improved supply dynamics and heightened competition among manufacturers, ultimately fostering growth in various application segments.

Expansion of Pharmaceutical and Chemical Industries

The Activated Carbon Market is benefiting from the expansion of the pharmaceutical and chemical sectors, which require activated carbon for various applications, including purification and recovery processes. The pharmaceutical industry, in particular, relies on activated carbon to ensure the removal of impurities and contaminants during drug manufacturing. Recent statistics indicate that the pharmaceutical segment is anticipated to grow significantly, potentially reaching a market share of 15% by 2025. This growth is attributed to the increasing demand for high-quality pharmaceuticals and the need for stringent quality control measures. Consequently, the activated carbon market is likely to see enhanced opportunities as these industries continue to expand and innovate.