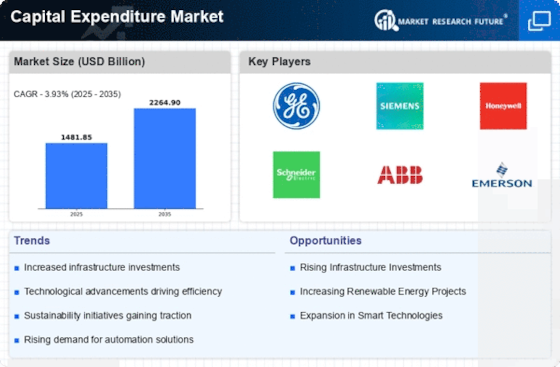

Infrastructure Development Initiatives

The Capital Expenditure Market is currently experiencing a surge in infrastructure development initiatives. Governments and private entities are increasingly investing in transportation, energy, and communication infrastructure to enhance connectivity and efficiency. For instance, in 2025, it is estimated that infrastructure spending will reach approximately 3 trillion dollars, driven by the need for modernization and expansion. This trend is likely to stimulate demand for capital expenditures as projects require substantial financial resources. Furthermore, the focus on public-private partnerships is expected to facilitate investment flows, thereby bolstering the Capital Expenditure Market. As nations prioritize infrastructure, the ripple effect on related sectors, such as construction and materials, becomes evident, indicating a robust growth trajectory for capital expenditures.

Increased Urbanization and Population Growth

Increased urbanization and population growth are driving forces behind the Capital Expenditure Market. As urban areas expand, the demand for housing, transportation, and public services intensifies, necessitating substantial capital investments. By 2025, urban populations are expected to rise significantly, leading to an estimated increase in capital expenditures related to urban infrastructure by over 25%. This trend compels governments and private entities to prioritize capital projects that address the needs of growing urban centers. The Capital Expenditure Market is thus likely to benefit from this demographic shift, as investments in urban development become critical for sustainable growth and improved quality of life.

Rising Demand for Renewable Energy Solutions

The rising demand for renewable energy solutions is a pivotal driver in the Capital Expenditure Market. As nations strive to meet climate goals and transition towards sustainable energy sources, investments in renewable energy infrastructure are surging. In 2025, capital expenditures in the renewable energy sector are projected to exceed 1 trillion dollars, reflecting a growing commitment to sustainability. This shift not only enhances energy security but also stimulates job creation and economic growth. The Capital Expenditure Market is thus poised for expansion as companies allocate resources towards solar, wind, and other renewable technologies. The interplay between energy demand and capital investment is likely to shape the future landscape of the industry.

Regulatory Changes and Compliance Requirements

Regulatory changes and compliance requirements are exerting a considerable influence on the Capital Expenditure Market. As governments implement stricter regulations regarding environmental standards and safety protocols, companies are compelled to allocate more capital towards compliance-related expenditures. In 2025, it is anticipated that compliance costs will constitute a significant portion of capital budgets, potentially exceeding 15% in certain sectors. This trend underscores the necessity for businesses to invest in sustainable practices and technologies, thereby impacting their overall capital expenditure strategies. Consequently, the Capital Expenditure Market is likely to evolve as organizations adapt to these regulatory landscapes, fostering innovation and investment in compliance-driven projects.

Technological Advancements in Capital Projects

Technological advancements are reshaping the Capital Expenditure Market, as organizations increasingly adopt innovative solutions to enhance project efficiency and reduce costs. The integration of artificial intelligence, machine learning, and data analytics into capital projects is becoming commonplace. In 2025, it is projected that investments in technology for capital projects will account for over 20% of total capital expenditures. This shift not only streamlines operations but also improves decision-making processes, leading to more effective allocation of resources. As companies leverage technology to optimize their capital expenditures, the industry is likely to witness a transformation in project management practices, ultimately driving growth in the Capital Expenditure Market.