Increased Regulatory Compliance

The human capital-management-software market is experiencing a surge in demand due to the heightened focus on regulatory compliance. Organizations are increasingly required to adhere to various labor laws and regulations, which necessitates robust software solutions to manage employee data and reporting. In the US, the Department of Labor has implemented stricter guidelines, compelling companies to invest in human capital-management software to ensure compliance. This trend is reflected in the market, which is projected to grow at a CAGR of 10.5% over the next five years. As businesses strive to avoid penalties and legal issues, the adoption of comprehensive software solutions becomes essential, driving growth in the human capital-management-software market.

Growing Focus on Talent Management

The human capital-management-software market is significantly driven by the growing focus on talent management. Organizations are increasingly prioritizing the acquisition, development, and retention of top talent to maintain a competitive edge. In the US, companies are investing in software that supports comprehensive talent management strategies, including performance management, succession planning, and learning and development. This shift is reflected in the market, which is projected to reach $15 billion by 2026. As businesses recognize the correlation between effective talent management and organizational success, the demand for specialized human capital-management software continues to rise, indicating a robust growth trajectory.

Shift Towards Remote Work Solutions

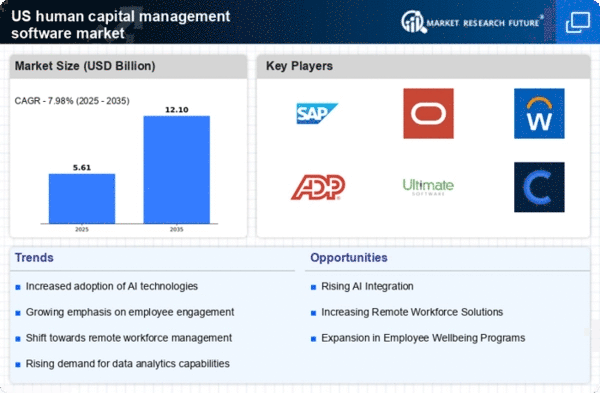

The human capital management software market is experiencing a notable shift towards remote work solutions. As organizations adapt to changing work environments, there is an increasing need for software that facilitates remote workforce management. This trend is particularly relevant in the US, where many companies are embracing hybrid work models. Human capital-management software that offers features such as virtual onboarding, remote performance tracking, and employee engagement tools is in high demand. The market is expected to grow by 15% over the next few years as businesses seek to enhance their remote work capabilities. This shift highlights the evolving nature of work and the critical role of technology in supporting workforce management.

Integration of Advanced Technologies

The integration of advanced technologies is a key driver in the human capital-management-software market. As organizations seek to enhance operational efficiency, the incorporation of technologies such as artificial intelligence, machine learning, and blockchain is becoming increasingly prevalent. These technologies enable automation of routine tasks, improve recruitment processes, and enhance employee engagement. In the US, companies are investing in software solutions that offer seamless integration with existing systems, thereby streamlining HR processes. The market is expected to witness a growth rate of 12% annually as businesses recognize the potential of these technologies to transform human capital management. This trend underscores the importance of innovative software solutions in the human capital-management-software market.

Emphasis on Data-Driven Decision Making

The human capital-management-software market is increasingly influenced by the emphasis on data-driven decision making. Organizations are recognizing the value of analytics in optimizing workforce management and enhancing productivity. By leveraging data analytics, companies can gain insights into employee performance, turnover rates, and recruitment effectiveness. This trend is particularly pronounced in the US, where businesses are investing heavily in software that provides real-time analytics and reporting capabilities. According to recent studies, organizations utilizing data-driven strategies have reported a 20% increase in employee engagement. Consequently, the demand for sophisticated human capital-management software that facilitates data analysis is on the rise, propelling the market forward.