Growing Focus on Sustainability

The Canadian Oilfield Chemical Market is increasingly aligning with sustainability initiatives as stakeholders demand more environmentally responsible practices. Companies are recognizing the importance of sustainable operations, which has led to the development of eco-friendly chemical products. The market for green chemicals is projected to grow significantly, as firms seek to reduce their carbon footprint and enhance their corporate social responsibility profiles. This shift not only meets regulatory requirements but also appeals to environmentally conscious consumers and investors. As a result, the Canadian Oilfield Chemical Market is likely to see a rise in the adoption of sustainable practices, which could redefine competitive dynamics in the sector.

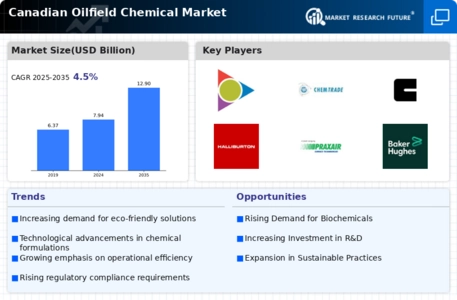

Increasing Demand for Oil and Gas

The Canadian Oilfield Chemical Market is experiencing a surge in demand for oil and gas, driven by the need for energy security and economic growth. As countries strive to meet their energy requirements, the exploration and production of oil and gas have intensified. This trend is reflected in the rising investments in oilfield services, which are projected to reach CAD 20 billion by 2026. The demand for oilfield chemicals, which enhance extraction processes and improve efficiency, is likely to grow in tandem. Consequently, companies in the Canadian Oilfield Chemical Market are focusing on developing innovative chemical solutions to cater to this increasing demand, thereby positioning themselves for future growth.

Strategic Partnerships and Collaborations

The Canadian Oilfield Chemical Market is witnessing a trend towards strategic partnerships and collaborations among key players. These alliances are often formed to leverage complementary strengths, share resources, and enhance innovation capabilities. By collaborating, companies can accelerate the development of new chemical solutions that address specific challenges in oil and gas extraction. This trend is particularly evident in joint ventures focused on research and development, which aim to create cutting-edge products that improve efficiency and reduce costs. As the market evolves, such partnerships are likely to play a crucial role in driving growth and ensuring that companies remain competitive in the dynamic landscape of the oilfield chemical sector.

Regulatory Compliance and Environmental Standards

The Canadian Oilfield Chemical Market is significantly influenced by stringent regulatory frameworks aimed at minimizing environmental impact. The government has implemented various regulations that require oil and gas companies to adopt environmentally friendly practices. This has led to a growing demand for specialty chemicals that comply with these regulations while ensuring operational efficiency. For instance, the use of biodegradable and non-toxic chemicals is becoming more prevalent, as companies seek to align with sustainability goals. The market for such chemicals is expected to expand, as firms invest in research and development to create compliant products that meet both regulatory standards and operational needs.

Technological Innovations in Chemical Formulations

Technological advancements are reshaping the Canadian Oilfield Chemical Market, particularly in the development of advanced chemical formulations. Innovations such as nanotechnology and smart chemicals are enhancing the performance of oilfield chemicals, leading to improved recovery rates and reduced operational costs. For example, the introduction of enhanced oil recovery (EOR) chemicals has shown potential in increasing extraction efficiency by up to 30%. As technology continues to evolve, companies are likely to invest in R&D to create more effective and efficient chemical solutions, thereby driving growth in the market. This focus on innovation is crucial for maintaining competitiveness in the rapidly changing landscape of the oil and gas sector.

Leave a Comment