Market Growth Projections

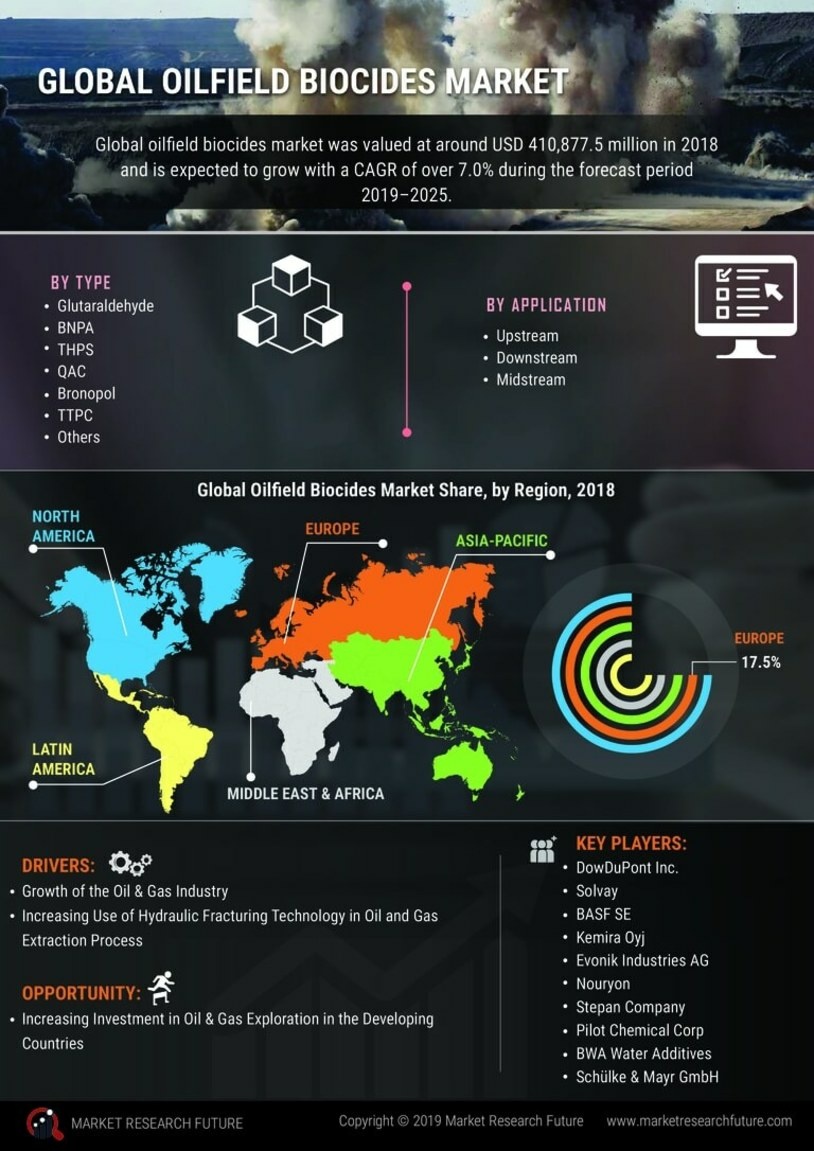

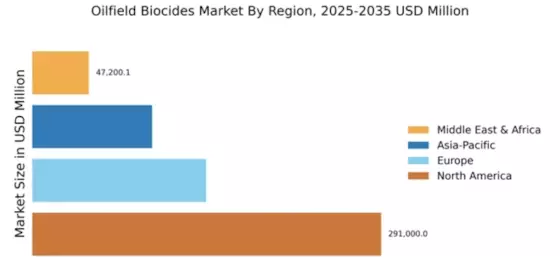

The Global Oilfield Biocides Market Industry is projected to experience substantial growth over the next decade. With a market value anticipated to reach 5120 USD Million by 2035, the industry is on a promising trajectory. The compound annual growth rate of 4.22% from 2025 to 2035 indicates a steady increase in demand for biocidal solutions. This growth is attributed to various factors, including rising exploration activities, regulatory compliance, and technological advancements. As the industry evolves, the need for effective biocides will likely remain a priority for oil and gas operators, ensuring the continued expansion of the Global Oilfield Biocides Market Industry.

Increasing Demand for Oilfield Services

The Global Oilfield Biocides Market Industry experiences heightened demand for oilfield services, driven by the continuous exploration and production activities across various regions. As oil and gas companies strive to enhance operational efficiency, the use of biocides becomes essential to mitigate microbial contamination in drilling fluids and production systems. This trend is reflected in the projected market value of 3250 USD Million in 2024, indicating a robust growth trajectory. The necessity for effective biocidal solutions to maintain the integrity of oilfield operations suggests a sustained demand for these products, thereby bolstering the Global Oilfield Biocides Market Industry.

Focus on Enhanced Oil Recovery Techniques

The focus on enhanced oil recovery techniques is driving the Global Oilfield Biocides Market Industry. As oilfields mature and production rates decline, operators are increasingly turning to enhanced recovery methods, which often require the use of biocides to prevent microbial growth that can hinder recovery processes. This trend is particularly evident in mature oilfields where maintaining production levels is critical. The integration of biocides in these techniques not only improves recovery rates but also ensures operational efficiency. As a result, the demand for biocidal solutions is expected to grow, further solidifying the market's position in the oil and gas sector.

Regulatory Compliance and Environmental Concerns

Regulatory compliance plays a pivotal role in shaping the Global Oilfield Biocides Market Industry. Governments worldwide are increasingly imposing stringent regulations regarding the use of chemicals in oilfield operations, particularly concerning environmental safety. Biocides that meet these regulatory standards are gaining traction, as companies seek to avoid penalties and enhance their sustainability profiles. This shift towards environmentally friendly biocides not only aligns with regulatory requirements but also appeals to stakeholders concerned about ecological impacts. Consequently, the demand for compliant biocidal solutions is likely to drive market growth, contributing to the projected increase in market value to 5120 USD Million by 2035.

Rising Exploration Activities in Emerging Markets

The Global Oilfield Biocides Market Industry is poised for growth due to rising exploration activities in emerging markets. Countries with untapped oil reserves are increasingly attracting investments, leading to a surge in drilling operations. This expansion necessitates the use of biocides to ensure the efficiency and safety of oil extraction processes. As these regions develop their oil and gas sectors, the demand for effective biocidal solutions is expected to rise correspondingly. This trend not only supports the growth of the Global Oilfield Biocides Market Industry but also highlights the potential for increased market penetration in regions previously overlooked by major oil companies.

Technological Advancements in Biocide Formulations

Technological advancements in biocide formulations are significantly influencing the Global Oilfield Biocides Market Industry. Innovations in chemical engineering have led to the development of more effective and less toxic biocides, which are increasingly favored by oil and gas operators. These advancements enhance the efficacy of biocides in combating microbial growth, thereby improving the overall performance of oilfield operations. As companies adopt these new formulations, the market is expected to witness a compound annual growth rate of 4.22% from 2025 to 2035. This trend underscores the importance of continuous research and development in driving the evolution of biocidal solutions within the industry.