Rising Demand for Enhanced Oil Recovery

The Specialty Oilfield Chemicals Market is experiencing a notable increase in demand for enhanced oil recovery (EOR) techniques. As conventional oil reserves deplete, operators are increasingly turning to EOR methods to maximize extraction from existing fields. This shift is driven by the need to maintain production levels and optimize resource utilization. According to recent estimates, EOR can potentially increase recovery rates by 10 to 60%, depending on the method employed. Consequently, the demand for specialty chemicals that facilitate these processes, such as surfactants and polymers, is expected to rise significantly. This trend not only underscores the importance of specialty oilfield chemicals in improving recovery efficiency but also highlights their role in ensuring the economic viability of aging oil fields.

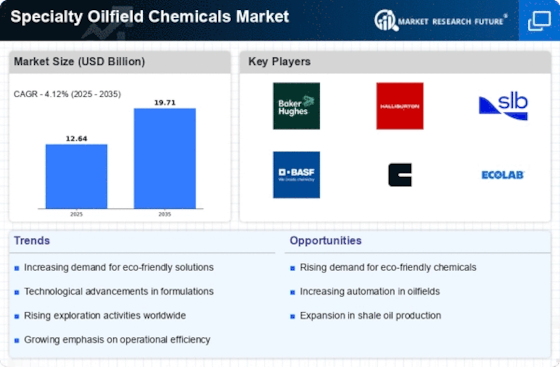

Increasing Investment in Oil and Gas Exploration

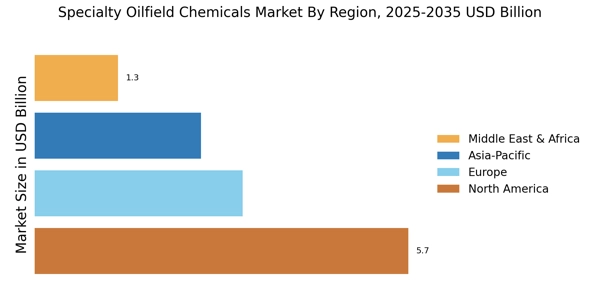

The Specialty Oilfield Chemicals Market is benefiting from a resurgence in investment in oil and gas exploration activities. As energy demand continues to rise, companies are allocating substantial resources towards exploring new reserves and enhancing existing operations. This trend is particularly evident in regions with untapped potential, where the need for specialty chemicals to support exploration and production activities is paramount. The market for specialty oilfield chemicals is projected to expand as exploration activities intensify, with a focus on chemicals that improve drilling efficiency and reduce operational risks. Additionally, the growing interest in unconventional resources, such as shale oil and gas, further amplifies the demand for specialized chemical solutions tailored to these unique extraction processes.

Regulatory Compliance and Environmental Concerns

The Specialty Oilfield Chemicals Market is increasingly influenced by stringent regulatory frameworks aimed at minimizing environmental impact. Governments and regulatory bodies are imposing stricter guidelines on chemical usage in oilfield operations, necessitating the adoption of environmentally friendly alternatives. This shift is prompting companies to invest in specialty chemicals that comply with these regulations while also enhancing operational efficiency. For instance, the use of biodegradable surfactants and non-toxic additives is gaining traction as companies seek to mitigate their ecological footprint. The market for such eco-friendly specialty chemicals is projected to grow, reflecting a broader trend towards sustainability in the oil and gas sector. This regulatory landscape not only drives innovation but also compels companies to reassess their chemical portfolios to align with evolving environmental standards.

Focus on Operational Efficiency and Cost Reduction

The Specialty Oilfield Chemicals Market is increasingly driven by the imperative for operational efficiency and cost reduction among oil and gas companies. In a competitive market landscape, firms are seeking ways to optimize their processes and minimize expenses. Specialty chemicals play a crucial role in achieving these objectives by enhancing the performance of drilling fluids, production chemicals, and other operational inputs. For instance, the use of high-performance additives can lead to significant reductions in downtime and operational costs. As companies strive to improve their bottom line, the demand for specialty oilfield chemicals that deliver measurable performance improvements is expected to grow. This focus on efficiency not only supports profitability but also encourages innovation in chemical formulations that meet the evolving needs of the industry.

Technological Innovations in Chemical Formulations

The Specialty Oilfield Chemicals Market is witnessing a surge in technological innovations that enhance chemical formulations used in oilfield applications. Advances in research and development are leading to the creation of more effective and efficient specialty chemicals tailored for specific challenges faced in oil extraction and production. For example, the introduction of smart polymers and advanced surfactants is revolutionizing the way oil is extracted, improving performance and reducing costs. These innovations are expected to drive market growth, as companies seek to leverage cutting-edge technologies to optimize their operations. Furthermore, the integration of digital technologies in chemical formulation processes is likely to enhance product performance and application efficiency, thereby solidifying the role of specialty chemicals in modern oilfield operations.