Increasing Cyber Threats

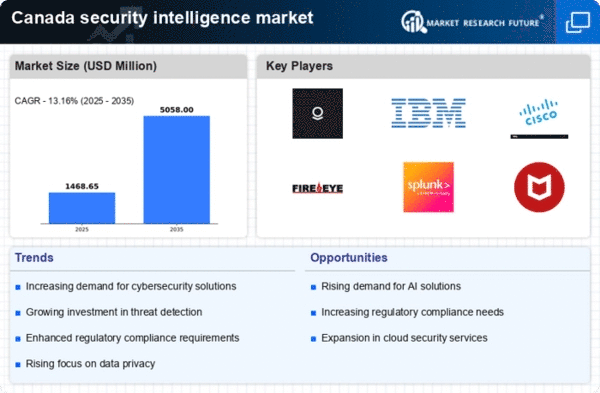

The security intelligence market in Canada is experiencing growth due to the rising frequency and sophistication of cyber threats. Organizations are increasingly targeted by cybercriminals, leading to a heightened demand for advanced security solutions. In 2025, it is estimated that cybercrime could cost Canadian businesses over $10 billion annually. This alarming trend compels companies to invest in security intelligence systems that can proactively identify and mitigate risks. As a result, the market is projected to expand at a CAGR of approximately 12% over the next five years. The need for robust security measures is further underscored by the increasing reliance on digital infrastructure across various sectors, including finance, healthcare, and government. Consequently, the security intelligence market is expected to grow significantly as organizations prioritize safeguarding their assets against evolving threats..

Integration of IoT Devices

The proliferation of Internet of Things (IoT) devices in Canada is significantly impacting the security intelligence market. As more devices become interconnected, the potential attack surface for cyber threats expands, necessitating enhanced security measures. In 2025, it is estimated that the number of IoT devices in Canada will exceed 1 billion, creating a pressing need for robust security frameworks. Organizations are increasingly aware that traditional security approaches may not adequately protect these devices, leading to a surge in demand for specialized security intelligence solutions. This trend is likely to drive innovation in the market, as companies seek to develop comprehensive security strategies that encompass IoT devices. Consequently, the integration of IoT security measures into existing frameworks is expected to be a key focus area for organizations, further propelling the growth of the security intelligence market.

Adoption of Advanced Analytics

The adoption of advanced analytics within the security intelligence market is transforming how organizations in Canada approach threat detection and response. By leveraging big data analytics, companies can gain deeper insights into potential vulnerabilities and emerging threats. In 2025, it is projected that the market for analytics-driven security solutions will reach approximately $1.5 billion in Canada. This growth is driven by the increasing volume of data generated by digital transactions and interactions, necessitating sophisticated analytical tools to process and interpret this information effectively. Organizations are recognizing that traditional security measures may no longer suffice, prompting a shift towards more proactive and data-driven security strategies. Consequently, the integration of advanced analytics into security intelligence frameworks is expected to enhance threat detection capabilities and improve overall security posture.

Regulatory Landscape Evolution

The evolving regulatory landscape in Canada is a critical driver for the security intelligence market. With the introduction of stringent data protection laws, such as the Personal Information Protection and Electronic Documents Act (PIPEDA), organizations are compelled to enhance their security measures. Compliance with these regulations is not merely a legal obligation; it is also essential for maintaining customer trust and brand reputation. In 2025, it is anticipated that compliance-related expenditures will account for approximately 20% of total security budgets in Canada. This shift indicates a growing recognition of the importance of security intelligence solutions in achieving regulatory compliance. As businesses navigate the complexities of these regulations, the demand for security intelligence tools that facilitate compliance and risk management is likely to surge, further propelling market growth.

Growing Demand for Managed Security Services

The security intelligence market in Canada is witnessing a notable shift towards managed security services (MSS). As organizations face resource constraints and a shortage of skilled cybersecurity professionals, many are opting to outsource their security needs to specialized providers. In 2025, the MSS segment is projected to account for over 30% of the total security spending in Canada. This trend reflects a growing recognition of the benefits of leveraging external expertise to enhance security posture. Managed security services offer organizations access to advanced technologies and threat intelligence that may be otherwise unattainable. Furthermore, the flexibility and scalability of MSS allow businesses to adapt their security strategies in response to evolving threats. As a result, the demand for managed security services is likely to continue to rise, driving growth in the security intelligence market.