Adoption of Advanced Technologies

The security analytics market in Canada is being propelled by the adoption of advanced technologies such as artificial intelligence (AI) and machine learning (ML). These technologies enhance the capabilities of security analytics tools, enabling organizations to analyze vast amounts of data quickly and accurately. In 2025, it is projected that the integration of AI and ML in security analytics could improve threat detection rates by up to 30%. This technological advancement allows for more effective identification of anomalies and potential threats, thereby reducing response times. As businesses increasingly recognize the value of these technologies, investment in security analytics solutions is likely to rise. The market is expected to benefit from this trend, as organizations seek to leverage advanced analytics to bolster their cybersecurity defenses and mitigate risks associated with cyber threats.

Growing Awareness of Data Privacy

The heightened awareness of data privacy among consumers and businesses in Canada is significantly influencing the security analytics market. With increasing incidents of data breaches, individuals are becoming more concerned about how their personal information is handled. This shift in consumer sentiment is prompting organizations to prioritize data protection measures. In 2025, it is estimated that 70% of Canadian consumers will choose to engage with companies that demonstrate a commitment to data privacy. Consequently, businesses are investing in security analytics solutions to enhance their data protection strategies and build consumer trust. This growing emphasis on data privacy is likely to drive the security analytics market, as organizations seek to implement robust analytics tools that ensure compliance with privacy regulations and safeguard sensitive information.

Increasing Cyber Threat Landscape

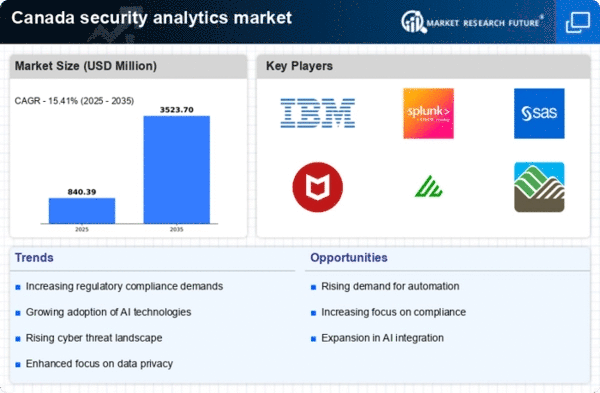

The security analytics market in Canada is experiencing growth due to the escalating cyber threat landscape. Organizations are increasingly targeted by sophisticated cyber attacks, which necessitate advanced security measures. In 2025, it is estimated that cybercrime could cost Canadian businesses over $10 billion annually. This alarming trend compels companies to invest in security analytics solutions to detect, analyze, and respond to threats in real-time. The need for proactive threat detection and incident response capabilities is driving demand for security analytics tools. As organizations recognize the importance of safeguarding sensitive data, the security analytics market is likely to expand significantly, with a projected CAGR of 15% over the next five years. This growth reflects a broader awareness of the need for robust cybersecurity frameworks in the face of evolving threats.

Regulatory Pressures and Compliance

In Canada, regulatory pressures are intensifying, prompting organizations to adopt security analytics solutions. Compliance with regulations such as the Personal Information Protection and Electronic Documents Act (PIPEDA) is crucial for businesses handling personal data. Non-compliance can result in hefty fines, which may reach up to $100,000 for organizations. As a result, the security analytics market is witnessing increased demand for tools that facilitate compliance monitoring and reporting. Companies are leveraging security analytics to ensure adherence to regulatory requirements while also enhancing their overall security posture. The market is expected to grow as organizations prioritize compliance and risk management, with an anticipated increase in investment in security analytics technologies to meet these challenges. This trend underscores the critical role of security analytics in navigating the complex regulatory landscape.

Investment in Digital Transformation

Ongoing investments in digital transformation initiatives across various sectors in Canada contribute to the growth of the security analytics market.. As organizations transition to digital platforms, they face new security challenges that necessitate advanced analytics solutions. In 2025, it is projected that Canadian businesses will allocate over $15 billion towards digital transformation efforts, with a significant portion directed towards enhancing cybersecurity measures. This investment is likely to drive demand for security analytics tools that can provide insights into potential vulnerabilities and threats. As companies embrace digital technologies, the need for comprehensive security analytics becomes paramount to protect against cyber risks. This trend indicates a strong correlation between digital transformation and the expansion of the security analytics market, as organizations strive to secure their digital assets.