Expansion of Cloud-Based Solutions

The shift towards cloud-based solutions significantly influences the graph analytics market in Canada. Organizations are increasingly adopting cloud technologies to facilitate scalable and flexible data management. This transition allows for enhanced collaboration and accessibility of data analytics tools, which is crucial for real-time decision-making. The Canadian cloud computing market is expected to reach $10 billion by 2026, indicating a robust environment for graph analytics solutions. As more companies migrate to the cloud, the demand for graph analytics tools that can seamlessly integrate with these platforms is likely to rise, further propelling the growth of the graph analytics market.

Increased Focus on Fraud Detection

Fraud detection remains a critical concern for many sectors in Canada, particularly in finance and e-commerce. The graph analytics market is poised to benefit from this heightened focus, as graph-based techniques are particularly effective in identifying complex patterns and anomalies indicative of fraudulent activities. Financial institutions are increasingly investing in advanced analytics solutions to mitigate risks and enhance security measures. The potential for graph analytics to uncover hidden relationships within large datasets positions it as a vital tool in the fight against fraud, thereby driving growth in the graph analytics market.

Emergence of Smart Cities Initiatives

The development of smart cities in Canada presents a unique opportunity for the graph analytics market. As urban areas increasingly adopt IoT technologies, vast amounts of data are generated, necessitating advanced analytics solutions to manage and interpret this information. Graph analytics can play a pivotal role in optimizing urban infrastructure, traffic management, and public safety. With government investments in smart city projects projected to exceed $1 billion by 2027, the demand for graph analytics tools that can analyze interconnected data from various sources is likely to increase, fostering growth in the graph analytics market.

Rising Demand for Data-Driven Insights

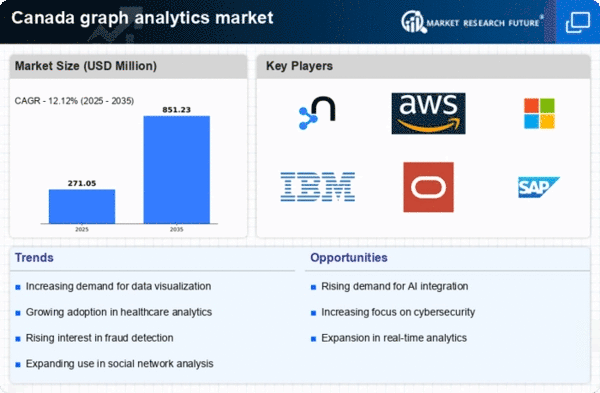

The graph analytics market in Canada experiences a notable surge in demand for data-driven insights across various sectors. Organizations are increasingly recognizing the value of leveraging complex data relationships to enhance decision-making processes. This trend is particularly evident in industries such as finance and healthcare, where data analytics can lead to improved operational efficiency and customer satisfaction. According to recent estimates, the market is projected to grow at a CAGR of approximately 25% over the next five years. As businesses strive to remain competitive, the integration of graph analytics into their data strategies becomes essential, driving the growth of the graph analytics market.

Growing Need for Enhanced Customer Experience

In the competitive landscape of Canadian businesses, enhancing customer experience has become paramount. The graph analytics market is well-positioned to address this need by providing insights into customer behavior and preferences. By analyzing relationships between different data points, organizations can tailor their offerings to meet customer demands more effectively. Companies that leverage graph analytics are likely to see improved customer retention rates and increased sales. As businesses continue to prioritize customer-centric strategies, the demand for graph analytics solutions is expected to rise, contributing to the expansion of the graph analytics market.