Evolving Consumer Expectations

Consumer expectations in Canada are evolving, with a heightened focus on quality and safety in food products. This shift is driving the cold chain-monitoring market as businesses strive to meet these demands. Consumers increasingly seek transparency regarding the handling and storage conditions of their food. As a result, companies are investing in sophisticated monitoring systems that provide real-time data on temperature and humidity. The cold chain-monitoring market is responding to this trend by developing solutions that enhance traceability and accountability, thereby fostering consumer trust. This is particularly relevant as the market for organic and locally sourced products continues to expand.

Government Initiatives and Support

Government initiatives aimed at enhancing food safety and quality are driving the cold chain-monitoring market in Canada. Regulatory bodies are increasingly emphasizing the need for stringent monitoring of temperature-sensitive products. This has led to the implementation of various programs and funding opportunities to support businesses in adopting advanced cold chain solutions. The cold chain-monitoring market benefits from these initiatives, as they encourage the adoption of best practices and technologies. Furthermore, the Canadian government is actively promoting research and development in this sector, which could lead to innovative solutions that address current challenges in cold chain logistics.

Rising Demand for Perishable Goods

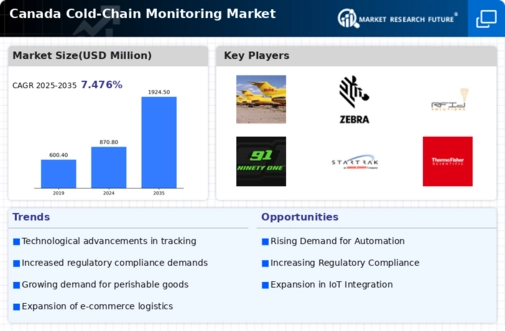

The increasing consumption of perishable goods in Canada is a primary driver for the cold chain-monitoring market. As consumers become more health-conscious, the demand for fresh produce, dairy, and meat products rises. This trend necessitates robust cold chain solutions to ensure product integrity and safety. According to recent data, the Canadian food and beverage sector is projected to grow by approximately 3.5% annually, further amplifying the need for effective cold chain monitoring. The cold chain-monitoring market must adapt to this growing demand by implementing advanced tracking technologies to maintain optimal temperature and humidity levels throughout the supply chain.

Technological Integration in Supply Chains

The integration of advanced technologies into supply chains is significantly impacting the cold chain-monitoring market. Innovations such as IoT devices, blockchain, and AI are being adopted to enhance monitoring capabilities. These technologies enable real-time tracking of temperature-sensitive products, reducing spoilage and waste. In Canada, the cold chain-monitoring market is witnessing a surge in investments in these technologies, with estimates suggesting a growth rate of around 10% annually. This technological evolution not only improves operational efficiency but also ensures compliance with safety regulations, thereby reinforcing the importance of effective cold chain management.

Growth of E-commerce and Online Grocery Shopping

The rapid growth of e-commerce and online grocery shopping in Canada is a significant driver for the cold chain-monitoring market. As more consumers turn to online platforms for their grocery needs, the demand for reliable cold chain solutions becomes critical. Ensuring that perishable items are delivered in optimal conditions is paramount for customer satisfaction. The cold chain-monitoring market is adapting to this shift by developing solutions that facilitate efficient last-mile delivery while maintaining product integrity. With e-commerce sales in the grocery sector projected to increase by over 15% annually, the need for effective cold chain monitoring is more pressing than ever.