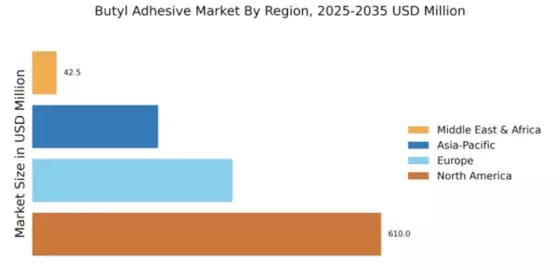

North America : Market Leader in Butyl Adhesives

North America is poised to maintain its leadership in the Butyl Adhesive market, holding a significant market share of $610.0M in 2025. The growth is driven by increasing demand in automotive, construction, and packaging sectors, alongside stringent regulations promoting the use of eco-friendly adhesives. The region's robust manufacturing capabilities and innovation in adhesive technologies further bolster market expansion.

The United States stands as the largest contributor, with key players like 3M, H.B. Fuller, and Dow leading the competitive landscape. The presence of advanced research facilities and a focus on sustainable practices are pivotal in shaping market dynamics. As companies invest in R&D, the North American market is expected to witness continuous growth, driven by technological advancements and strategic partnerships.

Europe : Emerging Market with Growth Potential

Europe's Butyl Adhesive market is projected to reach $350.0M by 2025, driven by increasing demand in automotive and construction industries. Regulatory frameworks emphasizing sustainability and safety are catalyzing the shift towards high-performance adhesives. The region's focus on innovation and eco-friendly products is expected to enhance market growth, with a notable rise in applications across various sectors.

Germany, France, and the UK are leading countries in this market, with major players like Henkel and BASF driving competition. The presence of established manufacturing facilities and a strong emphasis on R&D contribute to the region's competitive edge. As European companies adapt to changing regulations and consumer preferences, the Butyl Adhesive market is set for significant growth, supported by strategic collaborations and technological advancements.

Asia-Pacific : Rapid Growth in Emerging Economies

The Asia-Pacific region is witnessing rapid growth in the Butyl Adhesive market, projected to reach $220.0M by 2025. This growth is fueled by rising industrialization, urbanization, and increasing demand from the automotive and construction sectors. Countries like China and India are leading this surge, supported by favorable government policies and investments in infrastructure development, which are driving the demand for high-performance adhesives.

China is the dominant player in the region, with a growing number of local manufacturers entering the market. Key global players like Sika and Avery Dennison are also expanding their presence to capitalize on the burgeoning demand. The competitive landscape is characterized by innovation and strategic partnerships, as companies aim to enhance their product offerings and meet the diverse needs of consumers in this dynamic market.

Middle East and Africa : Emerging Market with Unique Challenges

The Middle East and Africa region is gradually emerging in the Butyl Adhesive market, with a projected size of $42.54M by 2025. The growth is primarily driven by increasing construction activities and a rising demand for automotive applications. However, challenges such as economic fluctuations and regulatory hurdles may impact market dynamics. The region's focus on infrastructure development is expected to create opportunities for adhesive manufacturers.

Countries like South Africa and the UAE are leading the market, with a mix of local and international players vying for market share. Companies are increasingly focusing on innovation and sustainability to meet the evolving needs of consumers. As the market matures, strategic collaborations and investments in R&D will be crucial for capturing growth opportunities in this region.