Butyl Adhesive Size

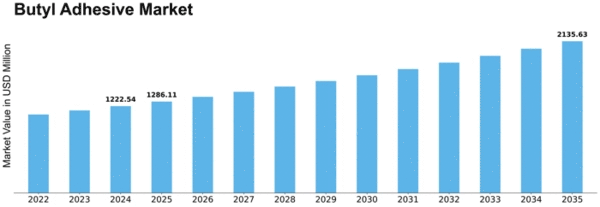

Butyl Adhesive Market Growth Projections and Opportunities

The Butyl Adhesive market is exposed to many factors that are interacting and mostly impacting the market in a way that the different applications of these adhesives makes them needed in the industries like automotive products, construction and packaging. Among prime focuses are growing demand for the product, where Butyl Adhesives manifest advantages over other products because of producing good adhesion, flexibility and resistance to environmental effects. Though the markets for these industries are heterogeneous, the demand for Butyl Adhesives is very significant impacting its performance and place as an important component of various manufacturing processes. Among the high values for environmental sustainability and regulatory measures, regulative tendencies and environmental awareness are the main points in the Butyl Adhesive market profile. Besides, Butyl Adhesives are basic ingredients in adhesives and sealants and therefore are deployed in both their safety, as well as the responsibility standards. Manufacturers have to take the rules of regulations into account, in order to satisfy the demands of their consumers who expect/seek environmentally-friendly products from the seller. It is worth noting that the adhesive industry gives due consideration to the development of low-VOC (volatile organic compound) formulations and eco-friendly alternatives, which demonstrate the trend towards sustainable approaches. As far as the components of global economy are concerned, the fairly essential factor in making the Butyl Adhesive market is economy.

The economical situation, especially, in such fields as building, automotive at the same time and lamination, directly influences the amount of consumption of these adhesives. Very often the business cycles include the phase of economic growth, which is accompanied by the intense interest from potential users for fast and secure bonding approach, that results in the significant increase in demand for Butyl Adhesives. While this truth may be reversed, economic crises are known to especially affect some industries thus a negative impact of trade on their market growth is also noted. Technology developments in adhesives do the most to market change. Genetic innovations in the research of polymers chemistry, how of curing, and functional modifications can expand the possibilities, diversity, and applicability of Butyl Adhesives. Technology-driven enterprises focusing more on research and development are the ones that will be able to be in touch with the current requirements and have more competitive edge in the market of Butyl Adhesive. Supply chain dynamics in which raw materials supply and price are the key issues play a crucial role in the Butyl Adhesive industry sector. These adhesives are the primary raw materials for the industry that include butyl rubber, fillers, and curing agents. The volatility of the prices of these raw materials may also be transmitted to the manufacturing costs, then the market may achieve price fluctuation as well. A well-organized and reliable supply chain considerably facilitates the process of delivering Butyl Adhesives to the final users, which prevents interruptions and remedies unsettled market.

Leave a Comment