Leading market players are investing heavily in research and development in order to expand their product lines, which will help the Business software services market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, Business software services industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global Business software services industry to benefit clients and increase the market sector. In recent years, the Business software services industry has offered some of the most significant advantages to medicine. Major players in the Business software services market, including Acumatica, Inc., Deltek, Inc., Epicor Software Corporation, International Business Machines Corporation, Infor., NetSuite Inc., Microsoft Corporation, SAP SE, Oracle Corporation, TOTVS S.A., Unit4, SYSPRO and others, are attempting to increase market demand by investing in research and development operations.

Information technology (IT) goods and services are offered by International Business Machines Corp (IBM). The business creates and markets software and hardware for computers, in addition to providing infrastructure, hosting, and consulting services. Analytics, automation, blockchain, cloud computing, IT infrastructure, IT management, cybersecurity, and software development tools are all part of IBM's product range. The business also provides services in the areas of cloud computing, networking, security, technology consulting, application services, business resilience services, and tech support services.

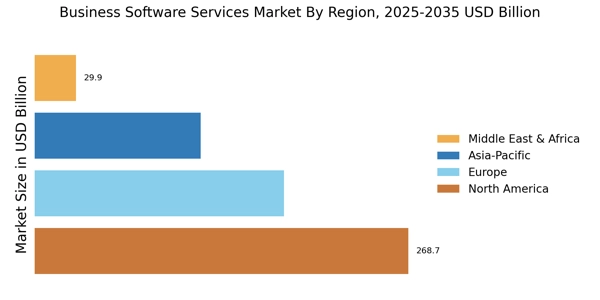

The industries it supports include those in the automobile, banking and financial markets, electronics, energy and utilities, healthcare, insurance, life sciences, manufacturing, metals and mining, retail and consumer goods, and telecommunication sectors. In addition to Asia-Pacific, the corporation also conducts business in the Americas, Europe, the Middle East, and Africa. The US city of Armonk, New York, serves as the home of IBM.

Deltek Inc (Deltek) provides software solutions for project-based businesses. The company provides commercial enterprise software and information solutions, including costpoint for manufacturing, conceptshare proofing for agencies, computer ease for construction, core human resource for professional services, and costpoint time and expense for government contractors. Businesses in the industries of aerospace & defense, architecture & engineering, cpa & accounting, energy, oil & gas, engineering procurement construction (EPC), government contracting, management & IT consulting, marketing firms, and nonprofit organizations can take advantage of Deltek's services. It offers clients practical knowledge that enables them to reach their maximum business potential.

The headquarters of Deltek are in Herndon, Virginia, in the United States.