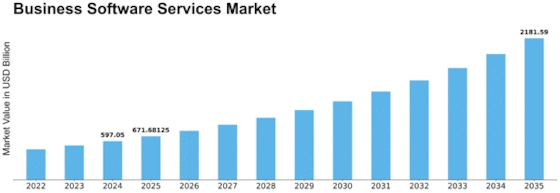

Business Software Services Size

Business Software Services Market Growth Projections and Opportunities

The business software services market is influenced by several key factors that drive its growth and impact its adoption across industries. Firstly, technological advancements play a significant role in shaping the business software services market. As new and more powerful software solutions emerge, the capabilities of business software services are enhanced, leading to increased demand for such technologies. The emergence and development of cloud computing, artificial intelligence (AI), and machine learning (ML) have revolutionized the business world by providing advanced software services that address various business needs.

In addition, the growing digital transformation initiatives in various industries have driven up demand for business software services. Organizations are adopting digital-technology in order to streamline their performance, increase efficiency and offer better services. Consequently, strong business software services are increasingly vital to enabling and fuelling these digital transformation programs due to being a critical component of the modern approach.

Moreover, the popularity of telecommuting and of virtual teams has boosted business software services. As companies have been moving toward flexible working arrangements, the seek software solutions that can provide smooth communication and collaboration as well project management among remote teams. This development drove the access to cloud-based business software services allowing remote work with employees always connected and productive no matter where they reside.

Additionally, data security and privacy have an immense effect on the business software services market. Organizations deal with sensitive business information; therefore, they always look forward to software solutions that offer strong security features, compliance options as well as data protection measures. Addressing security concerns as well aspects of providing secure environment for managing data and communicating is an important point that strongly influences the adoption rate of business software services and their market dynamics.

Additionally, another essential market factor is the availability of professional and expert people in business software services. As the necessity for such technologies increases, so does the demand to have professionals proficient in implementing and fine-tuning business software concoction. Not only is this factor a determinant of market growth, but it also influences the competitive sphere because companies strive to attract and retain top professionals in specific field.

Furthermore, the price and feasibility of implementing business software services as well are major market determinants. Organizations measure the profits and long-term gains of implementing business software services as part of their operations. With the falling prices of technology and emergence of more affordable solutions, there is a tendency for business software services market to grow while embracing in its coverage even less economically stable sectors. Furthermore, market factors such as industry partnerships, research and development activities, and the emergence of new use cases for business software services contribute to the overall growth and evolution of the market. Collaborations between technology companies, industry players, and software developers drive innovation and the development of new applications for business software services, expanding their market potential and fostering continuous advancements in the field.

Leave a Comment