Expansion of Streaming Services

The proliferation of streaming services in Brazil is significantly impacting the tv analytics market. With platforms such as Netflix, Amazon Prime Video, and local players gaining traction, there is an increasing need for analytics to optimize content offerings. In 2025, it is estimated that over 60% of Brazilian households will subscribe to at least one streaming service, creating a vast pool of viewer data. This data is essential for understanding viewing habits, peak usage times, and content preferences. Consequently, companies are investing heavily in analytics tools to harness this information, enabling them to make data-driven decisions regarding content acquisition and production. The competitive landscape among streaming services necessitates a robust analytics framework, as it allows for the identification of trends and viewer engagement metrics, ultimately enhancing the overall viewing experience in the tv analytics market.

Regulatory Changes and Compliance

The tv analytics market in Brazil is also influenced by evolving regulatory frameworks that govern data privacy and consumer protection. Recent legislation aimed at enhancing data security has prompted companies to adopt more sophisticated analytics solutions that comply with these regulations. As organizations navigate the complexities of data collection and usage, there is a growing emphasis on transparency and ethical data practices. This shift is likely to drive investment in analytics technologies that not only provide insights but also ensure compliance with legal standards. The market may see an increase in demand for analytics tools that incorporate privacy-by-design principles, allowing companies to maintain consumer trust while leveraging data for strategic decision-making. As such, regulatory changes are shaping the landscape of the tv analytics market, compelling businesses to adapt their strategies accordingly.

Growing Demand for Personalized Content

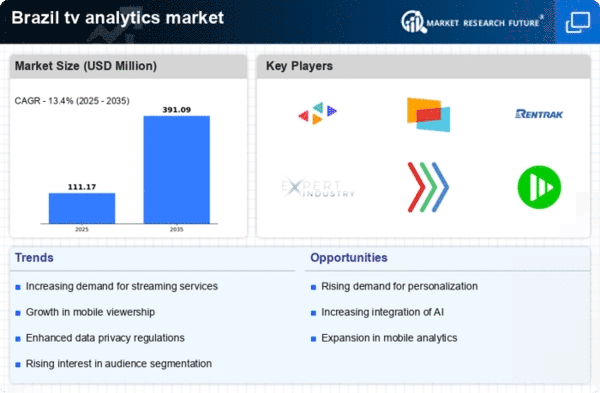

The tv analytics market in Brazil is experiencing a notable shift towards personalized content, driven by changing viewer preferences. As audiences increasingly seek tailored viewing experiences, broadcasters and streaming platforms are leveraging analytics to understand viewer behavior and preferences. This trend is reflected in the rising investment in data analytics tools, with the market projected to grow at a CAGR of 15% over the next five years. By utilizing viewer data, companies can enhance content recommendations, thereby improving viewer satisfaction and retention rates. The ability to analyze viewer demographics and preferences allows for targeted advertising, which is becoming a crucial revenue stream in the tv analytics market. As a result, the demand for sophisticated analytics solutions is likely to continue to rise, shaping the future of content delivery in Brazil.

Increased Focus on Advertising Effectiveness

The tv analytics market in Brazil is witnessing a heightened focus on measuring advertising effectiveness. As advertisers seek to maximize their return on investment, there is a growing demand for analytics solutions that can provide insights into ad performance and viewer engagement. In 2025, it is estimated that the advertising spend in the Brazilian tv sector will reach $5 billion, with a significant portion allocated to data-driven advertising strategies. Companies are increasingly utilizing analytics to track viewer interactions with advertisements, assess campaign effectiveness, and refine targeting strategies. This trend is likely to drive innovation in analytics tools, as businesses strive to enhance their advertising capabilities. By understanding viewer responses and preferences, advertisers can create more impactful campaigns, thereby contributing to the overall growth of the tv analytics market.

Technological Advancements in Data Processing

Technological innovations are playing a pivotal role in the evolution of the tv analytics market in Brazil. The advent of cloud computing, big data technologies, and advanced data processing capabilities is enabling companies to analyze vast amounts of viewer data in real-time. This technological shift allows for more accurate and timely insights into viewer behavior, which is essential for optimizing content strategies. In 2025, it is projected that investments in data processing technologies will account for approximately 30% of total spending in the tv analytics market. As organizations seek to enhance their analytical capabilities, the integration of these technologies is likely to lead to more effective audience segmentation and targeted marketing efforts. Consequently, the ability to leverage advanced data processing tools is becoming increasingly critical for success in the competitive landscape of the tv analytics market.