Focus on Workforce Optimization

Workforce optimization is emerging as a critical driver in the contact center-analytics market in Brazil. Organizations are increasingly recognizing the importance of optimizing their workforce to enhance productivity and service quality. Analytics tools that provide insights into agent performance, call handling times, and customer satisfaction are essential for identifying areas for improvement. By implementing workforce optimization strategies, companies can achieve a 30% increase in operational efficiency. This focus on maximizing human resources is likely to propel the demand for analytics solutions that support workforce management, training, and performance evaluation. As businesses strive to create a more efficient and effective workforce, the contact center-analytics market is expected to benefit significantly from this trend.

Integration of Omnichannel Communication

The integration of omnichannel communication strategies is becoming increasingly vital for the contact center-analytics market in Brazil. As customers engage through various channels such as social media, email, and live chat, businesses must ensure a seamless experience across these platforms. Analytics tools that can aggregate data from multiple sources are essential for understanding customer interactions holistically. This integration not only enhances customer satisfaction but also provides valuable insights into channel performance. Market analysis suggests that companies adopting omnichannel strategies can see a 20% increase in customer engagement. Consequently, the demand for sophisticated analytics solutions that support omnichannel communication is likely to escalate, further propelling the growth of the contact center-analytics market.

Growing Importance of Predictive Analytics

Predictive analytics is gaining traction within the contact center-analytics market in Brazil, as organizations seek to anticipate customer needs and behaviors. By utilizing historical data and advanced algorithms, businesses can forecast trends and make informed decisions. This capability is particularly valuable in optimizing resource allocation and improving operational efficiency. Recent studies indicate that companies employing predictive analytics can reduce operational costs by up to 25%. As firms strive to enhance their competitive edge, the integration of predictive analytics into contact center operations is expected to become a key driver of growth in the market. This trend underscores the necessity for analytics solutions that can provide actionable insights and support proactive decision-making.

Increased Investment in Cloud-Based Solutions

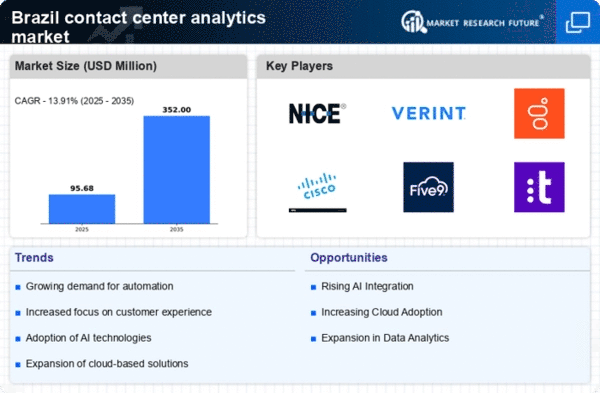

The shift towards cloud-based solutions is significantly influencing the contact center-analytics market in Brazil. Organizations are increasingly adopting cloud technologies to enhance scalability, flexibility, and cost-effectiveness. Cloud-based analytics platforms allow businesses to access real-time data and insights from anywhere, facilitating better decision-making and responsiveness to customer needs. Market data suggests that the cloud segment is anticipated to grow at a CAGR of 18% over the next few years. This transition not only reduces the burden of on-premises infrastructure but also enables companies to leverage advanced analytics capabilities without substantial upfront investments. As a result, the demand for cloud-based analytics solutions is likely to drive the expansion of the contact center-analytics market.

Rising Demand for Enhanced Customer Experience

The contact center-analytics market in Brazil is experiencing a notable surge in demand for enhanced customer experience. Companies are increasingly recognizing that superior customer service can lead to higher customer retention and loyalty. As a result, organizations are investing in analytics tools that provide insights into customer interactions, preferences, and behaviors. This trend is reflected in the market data, which indicates that the customer experience management segment is projected to grow at a CAGR of 15% through 2026. By leveraging analytics, businesses can identify pain points in the customer journey and implement targeted strategies to improve satisfaction. This focus on customer-centric approaches is likely to drive the growth of the contact center-analytics market, as firms seek to differentiate themselves in a competitive landscape.