Growing E-commerce Sector

The rapid expansion of the e-commerce sector in Brazil is driving the location analytics market. As online shopping becomes more prevalent, businesses are seeking ways to optimize their logistics and supply chain operations. Location analytics provides valuable insights into consumer demographics, regional preferences, and delivery efficiencies. Recent reports indicate that Brazil's e-commerce market is projected to reach $50 billion by 2025, creating a substantial demand for location-based solutions. Companies are increasingly investing in location analytics to enhance their competitive edge, streamline operations, and improve customer satisfaction. This trend is likely to continue, further fueling the growth of the location analytics market.

Rising Demand for Geospatial Data

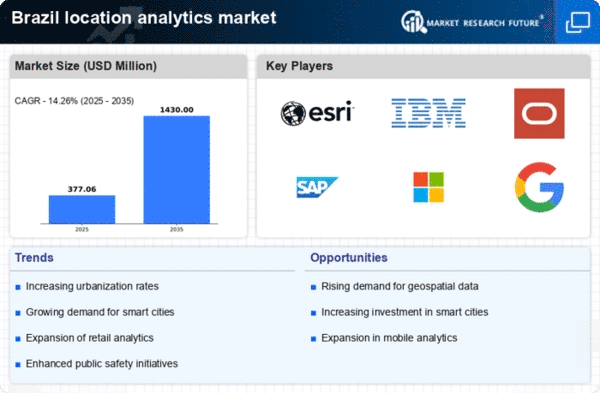

The location analytics market in Brazil is experiencing a notable surge in demand for geospatial data. This trend is driven by various sectors, including retail, transportation, and urban planning, which increasingly rely on location-based insights to enhance decision-making processes. According to recent estimates, the Brazilian geospatial data market is projected to grow at a CAGR of approximately 15% over the next five years. Companies are leveraging this data to optimize supply chains, improve customer targeting, and enhance operational efficiency. As organizations recognize the value of spatial intelligence, investments in location analytics tools are likely to increase, further propelling the growth of the location analytics market in Brazil.

Increased Mobile Device Penetration

The proliferation of mobile devices in Brazil is a key driver of the location analytics market. With over 90% of the population owning a mobile phone, businesses are increasingly utilizing mobile location data to gain insights into consumer behavior and preferences. This trend is particularly evident in the retail sector, where companies are employing location analytics to tailor marketing strategies and improve customer engagement. The mobile location data market in Brazil is expected to grow significantly, with estimates suggesting a CAGR of around 20% over the next few years. As mobile technology continues to advance, the demand for location analytics solutions is likely to expand, further enhancing the market landscape.

Enhanced Focus on Data Privacy Regulations

The evolving landscape of data privacy regulations in Brazil is impacting the location analytics market. With the implementation of the General Data Protection Law (LGPD), businesses are required to adopt more stringent measures regarding the collection and use of location data. This regulatory environment is prompting companies to invest in compliant location analytics solutions that ensure data security and privacy. As organizations navigate these regulations, the demand for location analytics tools that prioritize data protection is likely to increase. This focus on compliance may drive innovation within the location analytics market, as companies seek to balance the need for insights with the imperative of safeguarding consumer information.

Government Initiatives and Smart City Projects

Brazilian government initiatives aimed at developing smart cities are significantly influencing the location analytics market. These projects often incorporate advanced location-based technologies to improve urban infrastructure, transportation systems, and public services. For instance, the Brazilian government has allocated substantial funding for smart city initiatives, with investments expected to reach $1 billion by 2026. This focus on urban development creates a fertile ground for location analytics solutions, as they provide critical insights for city planners and policymakers. The integration of location analytics into these projects is likely to enhance efficiency and sustainability, thereby driving further growth in the location analytics market.