Advancements in Video Technology

Technological advancements are reshaping the enterprise video market in Brazil, driving innovation and enhancing user experiences. The introduction of high-definition video, interactive features, and improved streaming capabilities are transforming how businesses utilize video solutions. As organizations seek to deliver high-quality content, the demand for advanced video technologies is likely to increase. Recent trends indicate that 60% of Brazilian companies are prioritizing investments in cutting-edge video solutions to stay competitive. This focus on technology suggests a dynamic evolution within the enterprise video market, as businesses adapt to changing consumer preferences and technological advancements.

Expansion of E-Learning Platforms

The rise of e-learning platforms in Brazil is a critical driver for the enterprise video market. Educational institutions and corporate training providers are increasingly adopting video content to deliver courses and training sessions. This trend is fueled by the demand for flexible learning solutions that cater to diverse audiences. Data shows that the e-learning market in Brazil is expected to reach $3 billion by 2026, with video content being a key component of this growth. Consequently, the enterprise video market is poised to benefit from this expansion, as organizations seek to integrate video into their educational offerings to enhance accessibility and engagement.

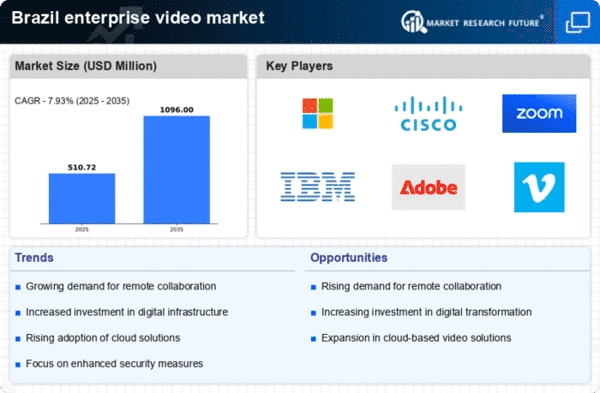

Growing Demand for Remote Collaboration

The enterprise video market in Brazil experiences a notable surge in demand for remote collaboration tools. As organizations increasingly adopt hybrid work models, the need for effective communication solutions becomes paramount. Video conferencing platforms facilitate real-time interaction, enabling teams to collaborate seamlessly regardless of their physical location. According to recent data, the market for video conferencing solutions in Brazil is projected to grow at a CAGR of 15% from 2025 to 2030. This growth is driven by the necessity for businesses to maintain productivity and engagement among remote employees. Consequently, the enterprise video market is witnessing a transformation, with companies investing in advanced video technologies to enhance their collaborative capabilities.

Rising Investment in Digital Transformation

Brazilian enterprises are significantly investing in digital transformation initiatives, which directly impacts the enterprise video market. Organizations recognize the importance of integrating modern technologies to improve operational efficiency and customer engagement. Video solutions play a crucial role in this transformation, offering innovative ways to deliver training, marketing, and customer support. Recent statistics indicate that 70% of Brazilian companies plan to increase their digital transformation budgets in the coming years. This trend suggests a robust growth trajectory for the enterprise video market, as businesses seek to leverage video content to enhance their digital presence and streamline communication processes.

Increased Focus on Employee Training and Development

The enterprise video market in Brazil is significantly influenced by the growing emphasis on employee training and development. Companies are increasingly utilizing video-based training programs to enhance learning experiences and improve knowledge retention. This shift is evident as organizations recognize that video content can effectively convey complex information in an engaging manner. Research indicates that organizations using video for training report a 50% increase in employee engagement. As a result, the enterprise video market is likely to expand, with businesses investing in video solutions that facilitate scalable and effective training programs.