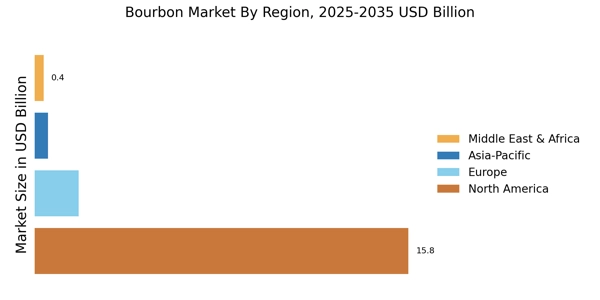

Expansion of Bourbon Exports

The bourbon Market is currently benefiting from a surge in exports, particularly to markets in Europe and Asia. Recent statistics indicate that bourbon exports have increased by over 20% in the past year, reflecting a growing international appreciation for this American spirit. Countries such as Japan and the United Kingdom are emerging as significant markets, where bourbon is increasingly recognized for its unique characteristics and heritage. This expansion is not only boosting sales for distilleries but also enhancing the global reputation of bourbon as a premium product. As international demand continues to rise, the Bourbon Market is poised for further growth, with distilleries exploring new distribution channels and marketing strategies to reach these diverse audiences.

Innovative Marketing Strategies

In the Bourbon Market, innovative marketing strategies are becoming essential for brands to differentiate themselves in a crowded marketplace. Distilleries are increasingly leveraging social media platforms and experiential marketing to engage consumers and build brand loyalty. For instance, virtual tastings and interactive distillery tours have gained popularity, allowing consumers to connect with brands in meaningful ways. Additionally, collaborations with chefs and mixologists are enhancing the visibility of bourbon in culinary contexts, further driving interest. This strategic approach not only attracts new consumers but also reinforces the brand's identity and heritage. As competition intensifies, the Bourbon Market must continue to adapt and innovate to capture the attention of a diverse consumer base.

Health Conscious Consumer Trends

The Bourbon Market is witnessing a shift in consumer preferences towards health-conscious choices, influencing purchasing decisions. As consumers become more aware of their health and wellness, there is a growing interest in lower-calorie and organic bourbon options. This trend is reflected in the introduction of brands that emphasize natural ingredients and sustainable production methods. Furthermore, the rise of bourbon cocktails that incorporate fresh ingredients and lower sugar content aligns with this health-conscious movement. Distilleries are responding by developing products that cater to these preferences, potentially expanding their market reach. The Bourbon Market must navigate this evolving landscape, balancing traditional practices with modern consumer demands.

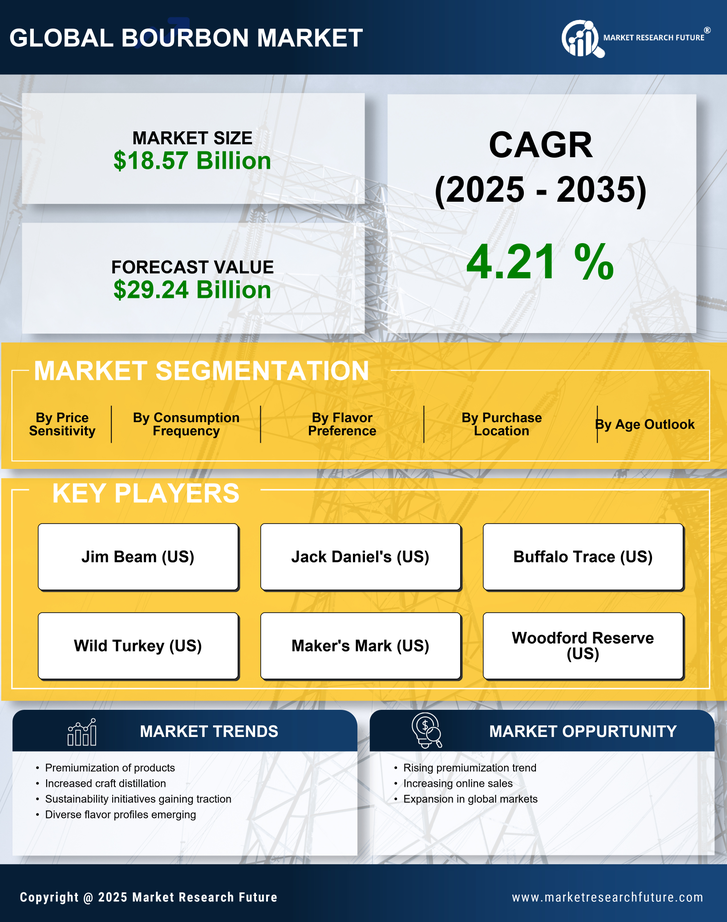

Rising Demand for Premium Bourbon

The Bourbon Market experiences a notable increase in demand for premium and super-premium bourbons. Consumers are increasingly willing to pay higher prices for quality, leading to a shift in purchasing behavior. According to recent data, the premium segment accounts for over 40% of total bourbon sales, indicating a strong preference for high-quality products. This trend is driven by a growing appreciation for craftsmanship and unique flavor profiles, as consumers seek out distinctive offerings. As a result, distilleries are focusing on small-batch production and innovative aging techniques to cater to this discerning audience. The Bourbon Market is thus witnessing a transformation, where quality supersedes quantity, and brands that emphasize heritage and authenticity are likely to thrive.

Cultural Significance and Heritage

The Bourbon Market is deeply intertwined with American culture and heritage, which continues to play a pivotal role in its growth. Bourbon Market is not merely a beverage; it represents a rich history and tradition that resonates with consumers. Events such as Bourbon Market festivals and tastings celebrate this heritage, drawing enthusiasts and newcomers alike. The cultural significance of bourbon is further amplified by storytelling and branding that highlight the craftsmanship and legacy of distilleries. This connection to culture fosters a sense of community among consumers, enhancing brand loyalty and engagement. As the Bourbon Market evolves, maintaining this cultural narrative will be crucial for brands seeking to establish a lasting presence in the market.