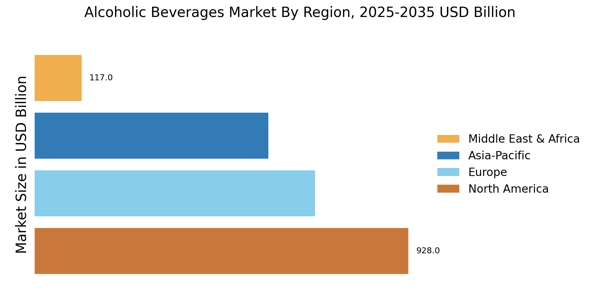

North America : Market Leader in Consumption

North America remains a key contributor to the North America rtd alcoholic beverages market, with strong performance in the Canada rtd alcoholic beverages market. Key growth drivers include a rising trend towards premiumization, health-conscious choices, and innovative product offerings. Regulatory support, such as favorable taxation policies, further fuels market expansion. The U.S. and Canada are the largest contributors, with the U.S. alone holding about 35% of the market share, driven by a diverse range of alcoholic products and a robust distribution network. The competitive landscape is characterized by major players like Anheuser-Busch InBev, Constellation Brands, and Molson Coors Beverage Company. These companies dominate the market with extensive portfolios that cater to various consumer preferences. The craft beer segment is also gaining traction, reflecting a shift towards local and artisanal products. Overall, the North American market is poised for continued growth, driven by innovation and changing consumer behaviors.

Europe : Diverse and Evolving Market

Europe continues to lead global consumption, supported by the Europe rtd alcoholic beverages market, including strong demand in the Germany rtd alcoholic beverages market, France rtd alcoholic beverages market, and UK rtd alcoholic beverages market. The region's growth is driven by a strong cultural affinity for alcoholic beverages, increasing demand for craft and premium products, and evolving consumer preferences towards low-alcohol and non-alcoholic options. Countries like Germany and the UK are the largest markets, with Germany accounting for about 12% of the total market share, supported by a rich beer culture and strong wine production. The competitive landscape in Europe is diverse, featuring key players such as Diageo, Heineken, and Pernod Ricard. The presence of numerous local breweries and distilleries adds to the market's vibrancy. Regulatory frameworks, including the EU's alcohol policy, promote responsible drinking while supporting innovation in product offerings. This dynamic environment fosters competition and encourages brands to adapt to changing consumer demands, ensuring sustained growth in the region.

Asia-Pacific : Emerging Market Potential

Asia-Pacific is witnessing rapid expansion in the China rtd alcoholic beverages market and Japan rtd alcoholic beverages market, driven by urbanization and premium consumption trends. Factors driving this growth include rising disposable incomes, urbanization, and changing social norms that favor alcohol consumption. China and Japan are the largest markets, with China alone accounting for approximately 15% of the market share, driven by a growing middle class and increasing acceptance of Western drinking habits. The competitive landscape is marked by both international and local players, including Asahi Group Holdings and Treasury Wine Estates. The region is witnessing a surge in demand for premium and imported beverages, particularly among younger consumers. Additionally, regulatory changes are encouraging innovation and diversification in product offerings, positioning the Asia-Pacific market for significant growth in the coming years.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa region represents a unique landscape for the alcoholic beverages market, currently holding about 5% of global consumption. The growth is primarily driven by increasing urbanization, a young population, and gradual shifts in cultural attitudes towards alcohol. South Africa is the largest market in the region, accounting for approximately 3% of the global market share, supported by a vibrant wine and beer culture, while other countries are slowly opening up to alcohol consumption. The competitive landscape is characterized by a mix of local and international players, with companies like Diageo and Pernod Ricard expanding their presence. Regulatory frameworks vary significantly across countries, impacting market dynamics. As more nations in the region consider liberalizing their alcohol laws, the potential for growth is substantial, making it an attractive market for investment and innovation.