Rising Incidence of Cyber Threats

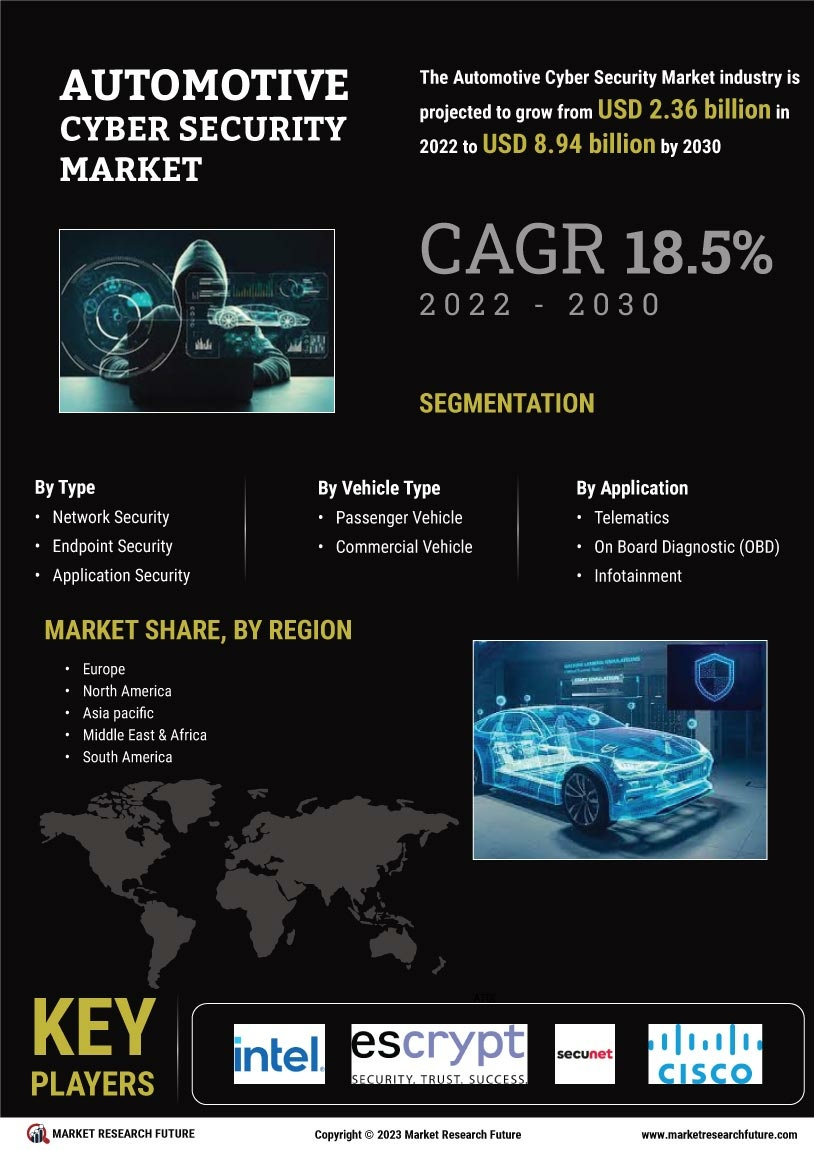

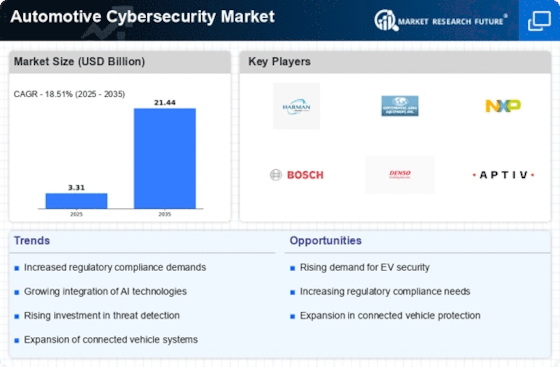

The Automotive Cybersecurity Market is experiencing a notable surge in demand due to the increasing frequency and sophistication of cyber threats targeting vehicles. As vehicles become more connected, the potential attack surface expands, making them attractive targets for cybercriminals. Reports indicate that the number of cyber incidents in the automotive sector has risen significantly, prompting manufacturers to prioritize cybersecurity measures. This trend is likely to drive investments in advanced security solutions, as stakeholders recognize the necessity of protecting sensitive data and ensuring the safety of vehicle operations. Consequently, the rising incidence of cyber threats is a critical driver for the Automotive Cybersecurity Market, compelling companies to adopt robust cybersecurity frameworks to mitigate risks.

Growing Adoption of Connected Vehicles

The Automotive Cyber Security Market is significantly influenced by the growing adoption of connected vehicles. As more consumers embrace features such as infotainment systems, navigation, and vehicle-to-everything (V2X) communication, the need for enhanced cybersecurity measures becomes paramount. Data suggests that the connected vehicle market is projected to reach substantial figures, with millions of vehicles expected to be connected by the end of the decade. This proliferation of connectivity introduces vulnerabilities that necessitate comprehensive cybersecurity strategies. Manufacturers are increasingly investing in cybersecurity solutions to safeguard against potential breaches, thereby propelling the growth of the Automotive Cybersecurity Market. The integration of secure communication protocols and encryption technologies is becoming essential to protect user data and maintain consumer trust.

Regulatory Pressures and Compliance Requirements

The Automotive Cybersecurity Market is also shaped by stringent regulatory pressures and compliance requirements imposed by governments and industry bodies. As the automotive landscape evolves, regulators are establishing frameworks to ensure the security of connected vehicles. For instance, regulations mandating cybersecurity measures in vehicle design and operation are becoming more prevalent. This regulatory environment compels manufacturers to invest in cybersecurity solutions to meet compliance standards, thereby driving market growth. The Automotive Cybersecurity Market is likely to see increased activity as companies strive to align with these regulations, which may include regular audits and assessments of cybersecurity practices. The emphasis on compliance not only enhances vehicle security but also fosters consumer confidence in the safety of connected vehicles.

Increased Consumer Awareness and Demand for Security

Consumer awareness regarding cybersecurity risks in the automotive sector is on the rise, significantly impacting the Automotive Cybersecurity Market. As individuals become more informed about potential threats, they are increasingly demanding secure vehicles equipped with advanced cybersecurity features. Surveys indicate that a considerable percentage of consumers prioritize cybersecurity when purchasing a vehicle, influencing manufacturers to enhance their security offerings. This shift in consumer behavior is likely to drive investments in cybersecurity technologies, as companies seek to meet the expectations of safety-conscious buyers. The Automotive Cybersecurity Market is thus experiencing a transformation, with manufacturers recognizing the importance of integrating robust security measures to attract and retain customers in a competitive landscape.

Technological Advancements in Cybersecurity Solutions

The Automotive Cybersecurity Industry is propelled by rapid technological advancements in cybersecurity solutions. Innovations such as artificial intelligence, machine learning, and blockchain technology are being integrated into automotive security systems to enhance threat detection and response capabilities. These technologies enable real-time monitoring and analysis of potential vulnerabilities, allowing manufacturers to proactively address security concerns. The market for cybersecurity solutions is projected to grow as companies seek to leverage these advancements to protect their vehicles from emerging threats. As a result, the Automotive Cybersecurity Market is likely to witness a surge in demand for cutting-edge security technologies that can adapt to the evolving landscape of cyber threats, ensuring the safety and integrity of connected vehicles.