Increased Cyber Threats

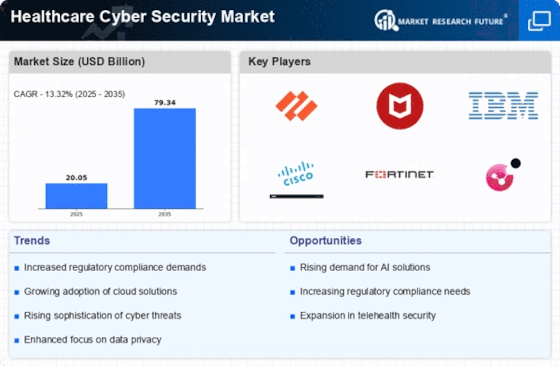

The Healthcare Cyber Security Market is experiencing heightened demand due to the increasing frequency and sophistication of cyber threats. Healthcare organizations are prime targets for cybercriminals, as they hold vast amounts of sensitive patient data. Reports indicate that healthcare data breaches have surged, with the number of reported incidents rising by over 50% in recent years. This alarming trend compels healthcare providers to invest in robust cybersecurity measures to protect their systems and patient information. As a result, the market for healthcare cybersecurity solutions is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 15% through the next several years. The urgency to safeguard against these threats is driving innovation and investment in the Healthcare Cyber Security Market.

Increased Focus on Data Privacy

The Healthcare Cyber Security Market is increasingly shaped by a heightened focus on data privacy. Patients are becoming more aware of their rights regarding personal information, leading to greater scrutiny of how healthcare organizations manage and protect data. This shift in consumer expectations is prompting healthcare providers to adopt more stringent cybersecurity practices. Market Research Future indicates that nearly 70% of patients express concerns about the security of their health information, which is driving demand for enhanced cybersecurity solutions. As a result, the Healthcare Cyber Security Market is likely to see a surge in investments aimed at improving data privacy measures, ensuring compliance with privacy regulations, and fostering patient trust in healthcare services.

Regulatory Compliance Requirements

The Healthcare Cyber Security Market is significantly influenced by stringent regulatory compliance requirements. Governments and regulatory bodies have established comprehensive frameworks to ensure the protection of patient data and healthcare information systems. For instance, regulations such as HIPAA in the United States mandate that healthcare organizations implement adequate security measures to safeguard sensitive information. Non-compliance can result in severe penalties, prompting healthcare providers to prioritize cybersecurity investments. The market is expected to expand as organizations seek to align with these regulations, with spending on compliance-related cybersecurity solutions projected to increase by approximately 20% annually. This regulatory landscape not only drives demand for cybersecurity solutions but also fosters a culture of accountability within the healthcare sector.

Growing Adoption of Telehealth Services

The Healthcare Cyber Security Market is witnessing a surge in demand due to the growing adoption of telehealth services. As healthcare providers increasingly offer remote consultations and digital health solutions, the need for secure communication channels and data protection becomes paramount. Telehealth platforms are often vulnerable to cyber threats, making robust cybersecurity measures essential. Market analysis indicates that the telehealth sector is expected to reach a valuation of over 250 billion dollars by 2026, further amplifying the need for effective cybersecurity solutions. This trend is likely to drive investments in the Healthcare Cyber Security Market, as organizations seek to protect patient data and maintain trust in digital health services. The integration of secure technologies will be crucial in ensuring the safe delivery of telehealth services.

Rising Investment in Healthcare IT Infrastructure

The Healthcare Cyber Security Market is benefiting from the rising investment in healthcare IT infrastructure. As healthcare organizations modernize their systems and adopt electronic health records, the complexity of their IT environments increases, leading to greater cybersecurity vulnerabilities. Reports suggest that healthcare IT spending is projected to exceed 500 billion dollars by 2025, with a significant portion allocated to cybersecurity solutions. This investment trend indicates a growing recognition of the importance of cybersecurity in safeguarding patient data and ensuring operational continuity. Consequently, the Healthcare Cyber Security Market is poised for growth as organizations prioritize the implementation of advanced security measures to protect their IT infrastructure from cyber threats.