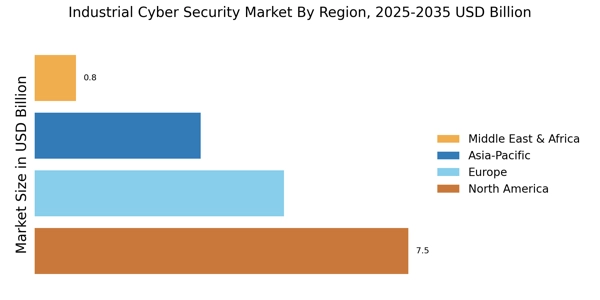

North America : Cybersecurity Innovation Leader

North America is the largest market for industrial cyber security, holding approximately 45% of the global share. The region's growth is driven by increasing cyber threats, stringent regulations, and a robust technological infrastructure. The demand for advanced security solutions is further fueled by the rise of IoT and Industry 4.0, prompting organizations to invest heavily in cybersecurity measures to protect critical infrastructure. The United States and Canada are the leading countries in this market, with major players like Honeywell, Rockwell Automation, and Cisco Systems establishing a strong presence. The competitive landscape is characterized by continuous innovation and strategic partnerships among key players. The focus on enhancing security protocols and compliance with regulations ensures that North America remains at the forefront of industrial cyber security advancements.

Europe : Regulatory Framework Strengthens Market

Europe is the second-largest market for industrial cyber security, accounting for around 30% of the global share. The region's growth is propelled by stringent regulations such as the GDPR and NIS Directive, which mandate robust cybersecurity measures across industries. The increasing frequency of cyberattacks and the need for compliance are driving organizations to invest in advanced security solutions, enhancing overall market demand. Leading countries in this region include Germany, France, and the UK, where companies like Siemens and Schneider Electric are key players. The competitive landscape is marked by a mix of established firms and emerging startups, all striving to innovate and meet regulatory requirements. The presence of a strong regulatory framework fosters a culture of cybersecurity awareness, further solidifying Europe's position in the industrial cyber security market.

Asia-Pacific : Emerging Market with High Potential

Asia-Pacific is witnessing rapid growth in the industrial cyber security market, holding approximately 20% of the global share. The region's expansion is driven by increasing digitalization, the adoption of smart manufacturing, and rising cyber threats. Governments are also implementing supportive policies to enhance cybersecurity frameworks, which further stimulates market growth. The demand for advanced security solutions is expected to surge as industries transition towards automation and IoT integration. Key countries in this region include China, Japan, and India, where companies like ABB and Fortinet are making significant strides. The competitive landscape is evolving, with both The Industrial Cyber Security Market share. The focus on innovation and collaboration among stakeholders is crucial for addressing the unique cybersecurity challenges faced by the region, positioning Asia-Pacific as a promising market for industrial cyber security solutions.

Middle East and Africa : Growing Awareness and Investment

The Middle East and Africa region is gradually emerging in the industrial cyber security market, accounting for about 5% of the global share. The growth is driven by increasing awareness of cyber threats and the need for robust security measures across various sectors, including oil and gas, manufacturing, and utilities. Governments are beginning to implement regulations and frameworks to enhance cybersecurity, which is expected to boost market demand in the coming years. Leading countries in this region include South Africa, the UAE, and Saudi Arabia, where investments in cybersecurity infrastructure are on the rise. The competitive landscape is characterized by a mix of local and international players, with a focus on developing tailored solutions to meet regional needs. As organizations prioritize cybersecurity, the Middle East and Africa are poised for significant growth in the industrial cyber security market.

Regional insights from the industrial cyber security market indicate robust demand in North America and rapid growth in Asia‑Pacific, supported by heightened awareness of cybersecurity risks and stringent regulatory frameworks. Comprehensive analysis of the cyber security market suggests that continuous innovation in network and endpoint security will remain essential for mitigating threats as industrial networks become increasingly interconnected.