Rising Industrialization

The rapid pace of industrialization is a crucial driver for the Water Treatment Biocide Market. As industries expand, the demand for effective water treatment solutions intensifies, particularly in sectors such as oil and gas, power generation, and food processing. The need to maintain water quality and prevent microbial contamination is paramount, leading to an increased reliance on biocides. Market data suggests that the industrial segment accounts for over 60% of the total demand for water treatment biocides. This trend underscores the importance of biocides in ensuring operational efficiency and compliance with health standards, thereby propelling the Water Treatment Biocide Market.

Increasing Water Scarcity

The escalating issue of water scarcity is a pivotal driver for the Water Treatment Biocide Market. As freshwater resources dwindle, industries are compelled to adopt effective water treatment solutions to ensure sustainability. This trend is particularly evident in sectors such as agriculture and manufacturing, where water is a critical resource. The demand for biocides that can effectively treat and recycle water is surging, with the market projected to reach USD 3.5 billion by 2026. This growth is indicative of the urgent need for innovative solutions to combat water scarcity, thereby propelling the Water Treatment Biocide Market forward.

Growing Awareness of Health Risks

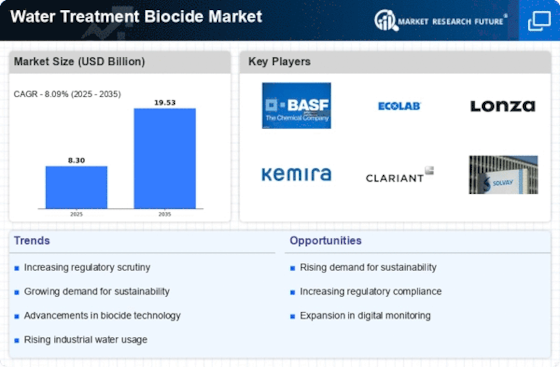

The growing awareness of health risks associated with waterborne pathogens is driving the Water Treatment Biocide Market. Consumers and industries alike are becoming increasingly cognizant of the potential health hazards posed by untreated water. This awareness is prompting a shift towards the use of biocides that effectively eliminate harmful microorganisms. The market is projected to grow at a CAGR of 5.2% from 2023 to 2028, reflecting the rising demand for safe and reliable water treatment solutions. As public health concerns continue to escalate, the Water Treatment Biocide Market is likely to experience sustained growth, driven by the need for effective biocidal products.

Stringent Environmental Regulations

The imposition of stringent environmental regulations is significantly influencing the Water Treatment Biocide Market. Governments are increasingly mandating the use of eco-friendly biocides to mitigate the adverse effects of traditional chemicals on ecosystems. This regulatory landscape is driving manufacturers to innovate and develop biocides that comply with environmental standards. For instance, the introduction of regulations such as the Clean Water Act has necessitated the adoption of safer biocidal products. Consequently, the market is witnessing a shift towards biocides that not only meet regulatory requirements but also enhance operational efficiency, thereby fostering growth in the Water Treatment Biocide Market.

Technological Innovations in Water Treatment

Technological innovations are reshaping the Water Treatment Biocide Market, offering new solutions for effective water management. Advancements in biocide formulations and application methods are enhancing the efficacy and safety of water treatment processes. For instance, the development of advanced oxidation processes and nanotechnology is enabling the creation of more potent biocides with reduced environmental impact. These innovations are not only improving treatment efficiency but also expanding the range of applications for biocides across various industries. As technology continues to evolve, the Water Treatment Biocide Market is poised for growth, driven by the demand for cutting-edge solutions that address contemporary water treatment challenges.