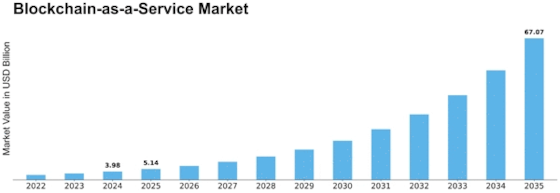

Blockchain Service Size

Blockchain Service Market Growth Projections and Opportunities

In the dynamic landscape of the Blockchain-as-a-Service (BaaS) market, companies employ various market share positioning strategies to gain a competitive edge. One prevalent approach involves differentiation through technological innovation. Companies strive to offer cutting-edge blockchain solutions, leveraging the latest advancements in distributed ledger technology. By staying at the forefront of innovation, these firms attract clients seeking sophisticated and efficient BaaS solutions, thus securing a substantial market share.

Another key strategy revolves around strategic partnerships and collaborations. In the rapidly evolving BaaS sector, companies recognize the value of forming alliances with other industry players, startups, or established enterprises. These partnerships can enhance product offerings, broaden service portfolios, and facilitate access to new markets. By strategically aligning with complementary businesses, companies can create a synergy that strengthens their market presence and enables them to address diverse customer needs.

Furthermore, pricing strategies play a pivotal role in market share positioning. Some companies opt for a cost leadership approach, aiming to provide BaaS solutions at a competitive price point without compromising quality. This strategy is particularly appealing to cost-sensitive customers and can contribute to market penetration. Conversely, premium pricing strategies cater to clients seeking exclusive features, enhanced security, or specialized services. By positioning themselves as premium BaaS providers, companies can carve out a niche in the market and capture a share of customers willing to pay for superior offerings.

Effective marketing and brand positioning also contribute significantly to market share strategies in the BaaS market. Companies invest in building a strong brand image, emphasizing factors such as reliability, security, and scalability. Through targeted marketing campaigns and thought leadership initiatives, businesses can differentiate themselves from competitors and establish a reputation that resonates with their target audience. A compelling brand narrative can influence customer perceptions, driving market preference and ultimately contributing to an increased market share.

Customer-centric approaches are increasingly gaining prominence as a market share positioning strategy in the BaaS sector. Understanding and addressing the unique requirements of clients is essential for sustained success. Companies that prioritize customer satisfaction, provide responsive support, and continually adapt their offerings based on customer feedback are likely to build long-term relationships and secure a loyal customer base. Positive customer experiences not only contribute to retention but also serve as a powerful marketing tool through word-of-mouth recommendations.

Lastly, global expansion strategies play a critical role in market share positioning in the BaaS market. As the demand for blockchain solutions transcends geographical boundaries, companies are keen to expand their footprint internationally. This may involve establishing regional offices, forming strategic alliances with local partners, or tailoring services to suit specific regional needs. By taking a proactive approach to global expansion, companies can tap into diverse markets, diversify their customer base, and fortify their position in the competitive BaaS landscape.

Leave a Comment