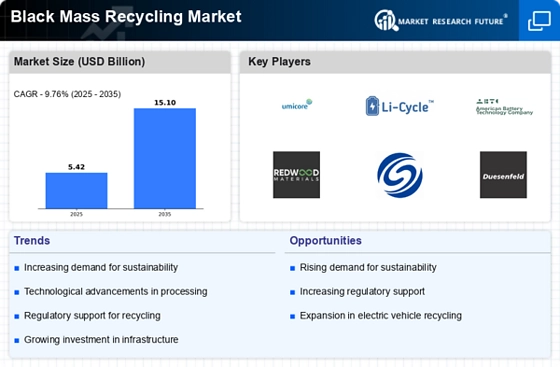

Growing Electric Vehicle Market

The Black Mass Recycling Market is closely linked to the burgeoning electric vehicle market, which is driving demand for battery recycling solutions. As electric vehicle sales continue to rise, the volume of spent batteries is expected to increase significantly. This trend presents both challenges and opportunities for the recycling industry. The need to recycle these batteries efficiently is becoming paramount, as manufacturers seek to recover valuable materials and reduce reliance on virgin resources. Projections indicate that the electric vehicle market could reach a valuation of USD 800 billion by 2030, further amplifying the demand for effective recycling solutions. Consequently, the Black Mass Recycling Market is poised for growth, as stakeholders recognize the importance of sustainable practices in meeting the needs of the electric vehicle sector.

Increasing Environmental Regulations

The Black Mass Recycling Market is significantly influenced by the tightening of environmental regulations aimed at reducing waste and promoting sustainable practices. Governments are implementing stricter policies regarding the disposal of electronic waste, particularly lithium-ion batteries, which contain hazardous materials. These regulations encourage manufacturers to adopt recycling practices that minimize environmental harm. For instance, the European Union's Battery Directive mandates that a certain percentage of batteries must be recycled, thereby creating a demand for efficient recycling solutions. As a result, companies in the Black Mass Recycling Market are likely to benefit from increased investment in recycling technologies and infrastructure to comply with these regulations. This regulatory landscape not only fosters innovation but also positions the industry as a key player in the transition towards a circular economy.

Investment in Recycling Infrastructure

The Black Mass Recycling Market is benefiting from increased investment in recycling infrastructure, which is essential for enhancing recycling capabilities. Governments and private entities are allocating funds to develop advanced recycling facilities that can efficiently process spent batteries. This investment is crucial for scaling up operations and improving the overall efficiency of the recycling process. For instance, several countries are establishing dedicated recycling plants that focus on extracting valuable metals from black mass, which is the residue left after battery processing. The establishment of such facilities is expected to create a more robust supply chain for recycled materials, thereby supporting the growth of the Black Mass Recycling Market. As infrastructure improves, the industry is likely to see enhanced recovery rates and reduced costs, making recycling a more viable option for manufacturers.

Rising Demand for Sustainable Materials

The Black Mass Recycling Market is witnessing a growing demand for sustainable materials, driven by consumer awareness and corporate responsibility initiatives. As industries strive to reduce their carbon footprints, the need for recycled materials, particularly from batteries, is becoming more pronounced. Companies are increasingly seeking to source materials from recycled sources to meet sustainability goals and comply with environmental standards. The market for recycled lithium, cobalt, and nickel is expected to expand, with estimates suggesting a potential increase in demand by over 30% in the next five years. This trend is likely to propel the Black Mass Recycling Market, as businesses recognize the economic and environmental benefits of utilizing recycled materials in their production processes.

Technological Innovations in Battery Recycling

The Black Mass Recycling Market is experiencing a surge in technological innovations that enhance the efficiency of battery recycling processes. Advanced techniques such as hydrometallurgical and pyrometallurgical methods are being developed to recover valuable metals like lithium, cobalt, and nickel from spent batteries. These innovations not only improve recovery rates but also reduce environmental impacts associated with traditional recycling methods. As the demand for electric vehicles continues to rise, the need for efficient recycling solutions becomes increasingly critical. The market for battery recycling is projected to reach USD 18 billion by 2030, indicating a robust growth trajectory. This technological evolution is likely to drive the Black Mass Recycling Market forward, as companies invest in state-of-the-art facilities and processes to meet the growing demand for recycled materials.