Regulatory Compliance

Regulatory compliance is a critical driver in the Forestry Machinery Market. Governments worldwide are implementing stringent regulations aimed at reducing environmental impact and promoting sustainable practices. These regulations often necessitate the adoption of advanced machinery that meets specific emissions standards and operational guidelines. For instance, the introduction of stricter emissions regulations in various regions has prompted manufacturers to innovate and develop industrial vacuum cleaner technologies. Market analysis indicates that compliance with these regulations not only enhances a company's reputation but also opens up new market opportunities. As a result, companies that proactively adapt to these regulatory changes are likely to gain a competitive edge in the Forestry Machinery Market. This trend underscores the importance of aligning product development with regulatory requirements to ensure long-term viability and success.

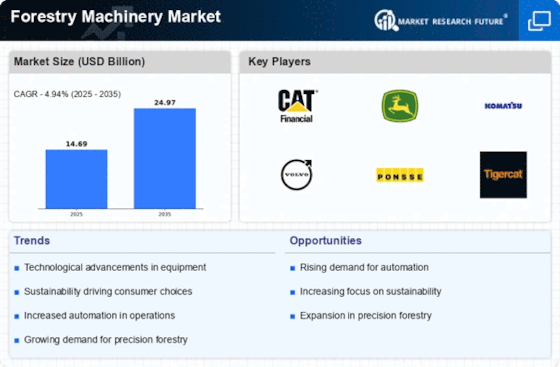

Rising Demand for Timber

The rising demand for timber is significantly impacting the Forestry Machinery Market. As construction and furniture industries expand, the need for efficient timber harvesting solutions is becoming increasingly pronounced. Market data indicates that the global demand for timber is projected to grow steadily, driven by urbanization and population growth. This surge in demand necessitates the use of advanced forestry machinery that can enhance productivity and reduce operational costs. Companies are responding by investing in high-performance equipment that can handle larger volumes of timber while ensuring sustainable practices. Furthermore, the emphasis on quality and efficiency in timber production is likely to drive innovation within the Forestry Machinery Market, as manufacturers seek to develop machinery that meets these evolving demands.

Technological Innovations

Technological innovations play a pivotal role in the Forestry Machinery Market. The integration of advanced technologies such as automation, artificial intelligence, and IoT is transforming traditional forestry operations. For example, the use of drones for aerial surveying and monitoring is gaining traction, allowing for more precise data collection and analysis. Additionally, machinery equipped with smart sensors can optimize performance and reduce downtime, enhancing productivity. Market data suggests that the adoption of these technologies could lead to a substantial increase in operational efficiency, with some estimates indicating a potential reduction in operational costs by up to 20%. As these innovations continue to evolve, they are likely to redefine the competitive landscape of the Forestry Machinery Market, compelling manufacturers to invest in research and development to stay ahead.

Sustainability Initiatives

The Forestry Machinery Market is increasingly influenced by sustainability initiatives. As environmental concerns rise, there is a growing demand for machinery that minimizes ecological impact. Companies are investing in equipment that reduces emissions and enhances fuel efficiency. For instance, the adoption of hybrid and electric machinery is on the rise, with projections indicating that these technologies could account for a significant share of the market by 2030. This shift not only aligns with regulatory requirements but also appeals to environmentally conscious consumers. Furthermore, sustainable forestry practices are becoming a standard, driving the need for advanced machinery that supports these initiatives. As a result, manufacturers are focusing on developing innovative solutions that meet both operational efficiency and environmental sustainability, thereby shaping the future of the Forestry Machinery Market.

Investment in Research and Development

Investment in research and development (R&D) is a crucial driver for the Forestry Machinery Market. As competition intensifies, companies are increasingly allocating resources to R&D to foster innovation and improve product offerings. This focus on R&D enables manufacturers to develop cutting-edge technologies that enhance the efficiency and sustainability of forestry operations. For instance, advancements in machine design and materials can lead to lighter, more durable equipment that performs better in challenging environments. Market trends suggest that companies that prioritize R&D are better positioned to adapt to changing market dynamics and consumer preferences. Additionally, collaboration with research institutions and technology partners can further accelerate innovation, ensuring that the Forestry Machinery Market continues to evolve in response to emerging challenges and opportunities.