Biochar Market Summary

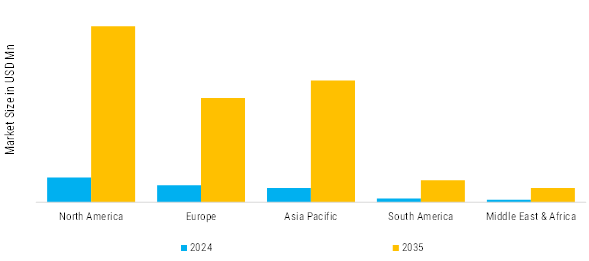

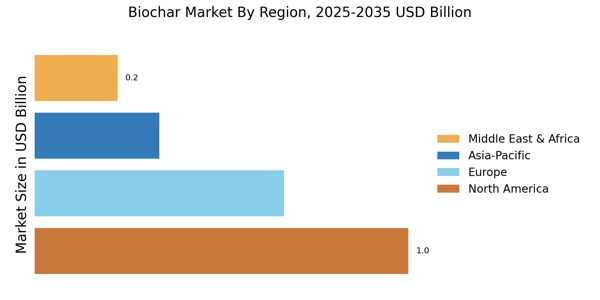

As per Market Research Future analysis, the Biochar Market Size was valued at USD 762.50 million in 2024. The Biochar Market industry is projected to grow from USD 876.88 million in 2025 to USD 3,640.39 million by 2035, exhibiting a compound annual growth rate (CAGR) of 15.3% during the forecast period (2025-2035).

Key Market Trends & Highlights

The Biochar Market is moving from a niche soil amendment into a mainstream climate and agricultural solution, and several powerful structural trends are shaping demand, pricing, and business models.

- Agriculture remains the dominant application, with some research putting farm and soil uses at around three‑quarters of global biochar revenue, driven by improved soil structure, better water retention, and higher nutrient efficiency.

- Biochar is increasingly bundled into regenerative and organic farming systems: farmers use it alongside composts, manures, and microbial inoculants to increase yields, reduce fertilizer needs, and enhance resilience to drought and heat, which positions it as a core soil‑health input rather than a standalone niche additive.

- A major emerging trend is the positioning of biochar as a durable carbon removal solution, not just a soil amendment; the carbon stored in stable biochar can remain in soils or materials for hundreds of years, making it attractive for high‑quality carbon credits.

- Corporate demand for durable carbon removal is expected to grow dramatically by 2030, and analysis of high‑quality biochar credit markets already shows large portions of future production locked into long‑term offtake contracts.

- Governments are promoting biochar through climate, waste, and agricultural policies, including incentives for negative‑carbon materials, standards for waste valorization, and support for soil carbon projects, which collectively lower risk and improve project economics

Market Size & Forecast

| 2024 Market Size | 762.50 (USD Million) |

| 2035 Market Size | 876.88 (USD Million) |

| CAGR (2025 - 2035) | 15.3% |

Major Players

Airex Energy, Ingelia S.L., Pacific Biochar Benefit Corporation, ArSta Eco, Arigna Fuels, Aries Clean, Meva Energy, Sonnenerde GmbH, Carbofex, NetZero & Others.