Rising Demand for Eco-Friendly Products

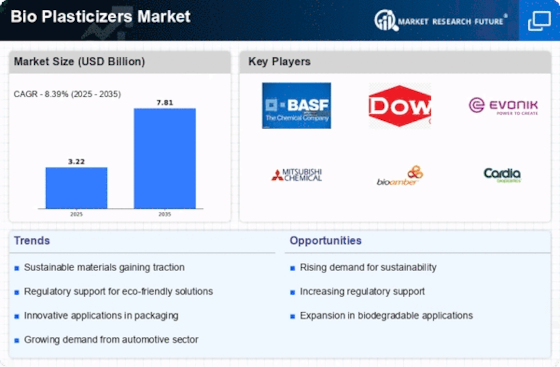

The increasing consumer awareness regarding environmental sustainability appears to drive the Bio Plasticizers Market. As consumers become more conscious of their ecological footprint, there is a notable shift towards products that are biodegradable and derived from renewable resources. This trend is reflected in the growing demand for bio-based plasticizers, which are perceived as safer alternatives to traditional petrochemical-based plasticizers. Market data indicates that the bio plasticizers segment is expected to witness a compound annual growth rate of approximately 10% over the next few years, suggesting a robust market potential. Companies are responding to this demand by innovating and expanding their product lines to include bio plasticizers, thereby enhancing their market presence and catering to environmentally conscious consumers.

Growing Applications in Various Industries

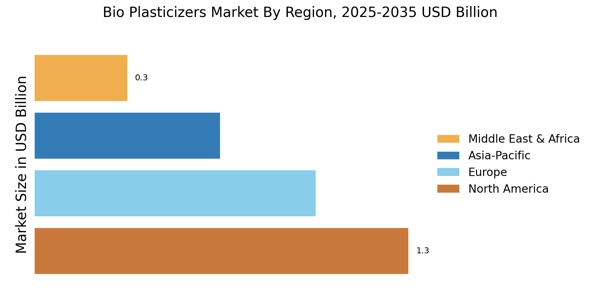

The versatility of bio plasticizers is contributing to their increasing adoption across multiple sectors, thereby driving the Bio Plasticizers Market. Industries such as automotive, construction, and consumer goods are increasingly utilizing bio plasticizers in their products due to their enhanced performance characteristics and environmental benefits. For instance, in the automotive sector, bio plasticizers are used in interior components to improve flexibility and durability while reducing environmental impact. Market data indicates that the construction industry is also embracing bio plasticizers for applications in adhesives and sealants, further expanding their market reach. This broadening application spectrum suggests a promising future for bio plasticizers, as more industries recognize their potential.

Regulatory Support for Sustainable Materials

The Bio Plasticizers Market is significantly influenced by regulatory frameworks that promote the use of sustainable materials. Governments across various regions are implementing stringent regulations aimed at reducing plastic waste and encouraging the adoption of bio-based alternatives. For instance, policies that mandate the use of biodegradable materials in packaging and construction are likely to bolster the demand for bio plasticizers. This regulatory support not only enhances market growth but also encourages manufacturers to invest in research and development of innovative bio plasticizers. As a result, the market is projected to expand, with an increasing number of companies aligning their strategies to comply with these regulations, thereby fostering a more sustainable industry landscape.

Consumer Preference for Healthier Alternatives

The growing consumer preference for healthier and safer alternatives is a key driver of the Bio Plasticizers Market. As awareness of the potential health risks associated with traditional plasticizers increases, consumers are actively seeking products that do not pose such risks. Bio plasticizers, being derived from natural sources, are perceived as safer options for various applications, including food packaging and children's toys. This shift in consumer behavior is prompting manufacturers to reformulate their products to include bio plasticizers, thereby aligning with market demands. The increasing emphasis on health and safety is likely to propel the growth of the bio plasticizers market, as companies strive to meet the evolving expectations of consumers.

Technological Innovations in Production Processes

Technological advancements in the production of bio plasticizers are poised to reshape the Bio Plasticizers Market. Innovations such as the development of new catalysts and fermentation processes are enhancing the efficiency and cost-effectiveness of bio plasticizer production. These advancements enable manufacturers to produce bio plasticizers at a lower cost, making them more competitive against traditional plasticizers. Furthermore, the integration of biotechnology in the production process is likely to improve the quality and performance of bio plasticizers, thereby expanding their application across various industries. Market analysts suggest that these technological innovations could lead to a significant increase in market share for bio plasticizers, as industries seek to adopt more sustainable practices.