Increased Regulatory Scrutiny

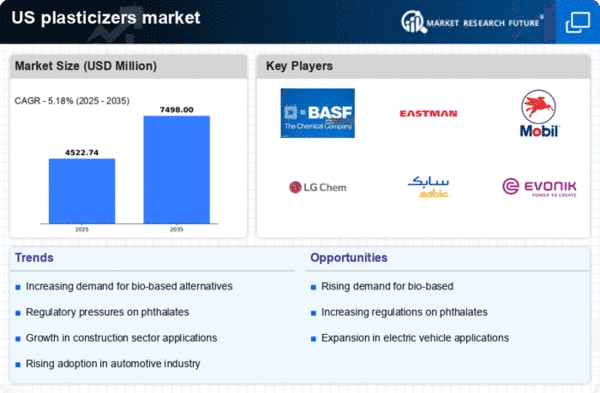

The US Plasticizers Market is currently navigating a landscape of heightened regulatory scrutiny, particularly concerning the safety and environmental impact of chemical substances. Regulatory bodies are increasingly focusing on the potential health risks associated with certain plasticizers, such as phthalates. This scrutiny has prompted manufacturers to innovate and develop safer alternatives, thereby reshaping the market dynamics. The introduction of stricter regulations may lead to a decline in the use of certain traditional plasticizers, while simultaneously creating opportunities for the growth of safer, compliant alternatives. As a result, the market is expected to adapt, with a potential shift towards non-toxic plasticizers that meet regulatory standards, thereby influencing purchasing decisions across various sectors.

Growth in the Automotive Sector

The US Plasticizers Market is significantly influenced by the growth of the automotive sector, which increasingly relies on plasticizers to enhance the performance of materials used in vehicle manufacturing. As automotive manufacturers strive for lightweight materials to improve fuel efficiency, plasticizers play a vital role in achieving the desired flexibility and durability in components such as dashboards, wiring, and seals. The automotive industry is projected to expand, with estimates indicating a growth rate of approximately 3% annually. This growth is likely to drive the demand for plasticizers, as manufacturers seek to meet the evolving requirements for performance and sustainability in vehicle production, thereby reinforcing the importance of plasticizers in this sector.

Expansion of the Packaging Industry

The US Plasticizers Market is benefiting from the expansion of the packaging industry, which increasingly utilizes plasticizers to enhance the properties of flexible packaging materials. As consumer preferences shift towards convenience and sustainability, the demand for flexible packaging solutions is on the rise. Plasticizers are essential in improving the flexibility, transparency, and durability of packaging materials, making them more appealing to manufacturers and consumers alike. The packaging industry is expected to grow at a rate of around 4% annually, driven by the increasing demand for food and beverage packaging, as well as e-commerce packaging solutions. This growth is likely to bolster the demand for plasticizers, highlighting their critical role in the evolving landscape of the packaging sector.

Rising Demand for Flexible Materials

The US Plasticizers Market is experiencing a notable increase in demand for flexible materials, particularly in the construction and automotive sectors. As industries seek to enhance product performance, plasticizers are essential in improving the flexibility and durability of materials such as PVC. The construction sector alone is projected to grow, with plasticizers playing a crucial role in the production of pipes, flooring, and roofing materials. This trend is further supported by the increasing use of flexible packaging in consumer goods, which is anticipated to drive the demand for plasticizers. The market for flexible materials is expected to expand, potentially leading to a compound annual growth rate of around 4% over the next few years, thereby reinforcing the significance of plasticizers in various applications.

Innovations in Bio-based Plasticizers

The US Plasticizers Market is witnessing a shift towards bio-based plasticizers, driven by the growing consumer preference for sustainable products. Innovations in bio-based alternatives are emerging as manufacturers seek to reduce their environmental footprint. These bio-based plasticizers, derived from renewable resources, offer comparable performance to traditional petroleum-based options while addressing sustainability concerns. The market for bio-based plasticizers is projected to grow significantly, with estimates suggesting a potential increase of 20% in market share by 2027. This shift not only aligns with regulatory trends favoring eco-friendly materials but also caters to the evolving demands of environmentally conscious consumers, thereby enhancing the overall appeal of the US Plasticizers Market.