Rising Environmental Awareness

The increasing awareness regarding environmental issues appears to be a pivotal driver for the Biodegradable Plastics Market. Consumers are becoming more conscious of the detrimental effects of traditional plastics on ecosystems and human health. This shift in consumer behavior is reflected in market data, indicating a notable rise in demand for sustainable alternatives. In 2023, the biodegradable plastics segment accounted for approximately 15% of the total plastics market, showcasing a growing preference for eco-friendly products. As individuals and organizations alike prioritize sustainability, the Biodegradable Plastics Market is likely to experience accelerated growth, driven by a collective push towards reducing plastic waste and promoting environmentally responsible practices.

Government Regulations and Policies

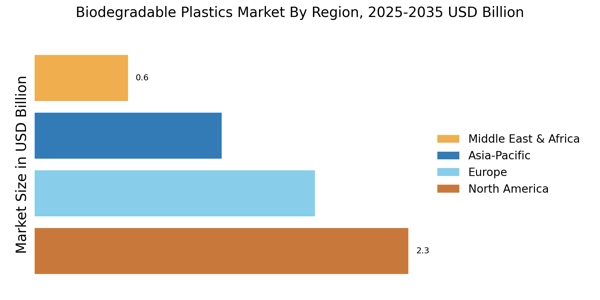

Government regulations and policies play a crucial role in shaping the Biodegradable Plastics Market. Many countries have implemented stringent regulations aimed at reducing plastic waste and promoting biodegradable alternatives. For instance, several regions have introduced bans on single-use plastics, thereby creating a favorable environment for biodegradable options. Market data suggests that regions with robust regulatory frameworks have witnessed a surge in the adoption of biodegradable plastics, with a projected growth rate of 20% in the next five years. This regulatory support not only encourages manufacturers to innovate but also enhances consumer confidence in biodegradable products, further propelling the market forward.

Corporate Sustainability Initiatives

Corporate sustainability initiatives are increasingly driving the Biodegradable Plastics Market as businesses recognize the importance of environmental responsibility. Many companies are adopting sustainable practices, including the use of biodegradable materials in their products and packaging. This trend is supported by market data showing that brands that prioritize sustainability experience higher customer loyalty and brand reputation. In 2023, approximately 30% of major corporations reported integrating biodegradable plastics into their supply chains, reflecting a commitment to reducing their environmental footprint. As more companies embrace these initiatives, the demand for biodegradable plastics is expected to rise, further solidifying the market's growth trajectory.

Innovations in Biodegradable Materials

Innovations in biodegradable materials are significantly influencing the Biodegradable Plastics Market. Advances in material science have led to the development of new biodegradable polymers that offer enhanced performance and versatility. For example, the introduction of polylactic acid (PLA) and polyhydroxyalkanoates (PHA) has expanded the range of applications for biodegradable plastics, from packaging to agricultural films. Market data indicates that the PLA segment alone is expected to grow at a compound annual growth rate of 15% over the next five years. These innovations not only improve the functionality of biodegradable plastics but also address consumer concerns regarding durability and usability, thereby fostering greater acceptance in various sectors.

Consumer Preference for Eco-Friendly Products

Consumer preference for eco-friendly products is a significant driver of the Biodegradable Plastics Market. As sustainability becomes a key purchasing criterion, consumers are actively seeking products that align with their values. Market data reveals that nearly 70% of consumers are willing to pay a premium for biodegradable options, indicating a strong market potential. This shift in consumer behavior is prompting manufacturers to expand their offerings of biodegradable plastics, catering to the growing demand for sustainable solutions. The Biodegradable Plastics Market is likely to benefit from this trend, as businesses strive to meet the expectations of environmentally conscious consumers.