Top Industry Leaders in the Big Data Software Market

Competitive Landscape of Big Data Software Market:

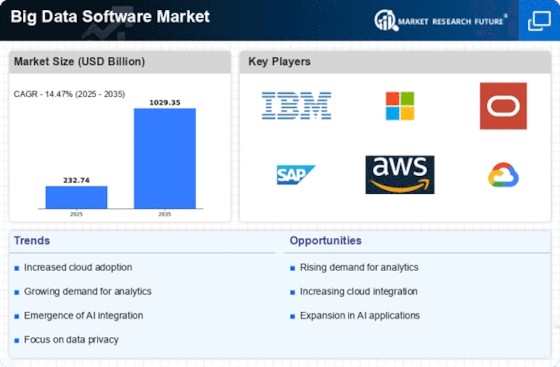

The Big Data Software Market is witnessing substantial growth driven by the increasing volume of data generated across various industries and the need for advanced analytics solutions. Several key players dominate this competitive landscape, each employing distinct strategies to secure and expand their market presence.

Key Players:

- IBM

- Oracle

- SAS Institute

- Microsoft

- HPE

- Guavus

- Splunk

- Palantir Technologies

- Amazon Web Services

- SAP

- Dell Technologies

- Hitachi

- Teradata

- Cloudera

- 10data

Strategies Adopted:

- Cloud Integration: Many key players are emphasizing cloud integration, recognizing the increasing preference for cloud-based solutions. This allows for greater scalability, flexibility, and cost-effectiveness.

- AI and Machine Learning Integration: Big data software vendors are incorporating artificial intelligence (AI) and machine learning (ML) capabilities into their offerings to enhance predictive analytics and data-driven decision-making.

- Open Source Initiatives: Some players are actively participating in open-source initiatives, fostering collaboration and innovation within the big data community. This strategy often helps in attracting a broader user base.

Factors for Market Share Analysis:

- Innovation and R&D: Companies investing significantly in research and development tend to stay ahead in the market. Regularly updating and enhancing software capabilities is crucial for sustained competitiveness.

- Global Reach: The ability to cater to a diverse global market and adapt solutions to regional requirements contributes to a higher market share.

- Customer Satisfaction: The level of customer satisfaction and retention is a key factor. Companies providing user-friendly interfaces, robust support, and continuous improvement based on customer feedback tend to capture a larger market share.

New and Emerging Companies:

- Cloudera: Specializing in big data analytics, Cloudera is gaining traction with its modern data platform, addressing various data management and analytics needs.

- Snowflake Inc.: Focused on cloud-based data warehousing, Snowflake has emerged as a disruptive force, providing a platform that enables seamless and scalable data storage and analytics.

- Databricks: Known for its unified analytics platform, Databricks is gaining popularity for its collaborative and integrated approach to big data analytics, especially in the context of Apache Spark.

Current Company Investment Trends:

- Acquisitions and Mergers: Key players are actively acquiring or merging with other companies to strengthen their product portfolios and expand market reach. Example: Microsoft's acquisition of GitHub to enhance its developer-focused offerings.

- Focus on Industry-Specific Solutions: Companies are investing in developing industry-specific big data solutions to address unique challenges and requirements. Example: SAP's industry-specific analytics solutions catering to sectors like healthcare and retail.

- Partnerships and Collaborations: Collaborative efforts with other technology or industry players are becoming increasingly common to create integrated solutions. Example: AWS partnering with data visualization tools to offer a more comprehensive analytics ecosystem.

Latest Company Updates:

December 5, 2023: Gartner identifies hyperautomation and data fabric as two key trends driving the big data software market in 2024.

January 8, 2024: Forbes highlights the growing adoption of cloud-based big data solutions as a major factor contributing to market growth.

November 10, 2023: Snowflake acquires data lake service provider, Streamlit, for $800 million.

December 22, 2023: Google Cloud announces plans to acquire big data analytics firm Looker for $3 billion.

September 20, 2023: Microsoft unveils Azure Synapse Link for Cosmos DB, a new service that simplifies large-scale data analytics on real-time data.

December 14, 2023: IBM introduces the IBM Quantum System One, the world's first commercial quantum computer designed for big data applications.

Dec 22, 2023: Snowflake acquires data lake provider Iguazio for $435 million, aiming to strengthen its cloud data platform. This acquisition will expand Snowflake's offerings and target new market segments.

Dec 19, 2023: Microsoft partners with SAP on big data and analytics solutions, aiming to provide seamless integration for enterprise customers. This partnership combines Microsoft's Azure cloud platform with SAP's HANA in-memory database for enhanced data management capabilities.

Nov 08, 2023: Teradata announces new cloud-native data warehouse platform, aiming to compete with cloud giants like Amazon Web Services and Google Cloud Platform. This launch underscores Teradata's efforts to adapt its offerings to the changing cloud landscape.