Expansion of IoT Devices

The proliferation of Internet of Things (IoT) devices is significantly influencing the big data-software market in Spain. As more devices become interconnected, the volume of data generated is expected to increase exponentially. This influx of data necessitates advanced big data software solutions capable of processing and analyzing vast datasets in real-time. Reports suggest that the number of IoT devices in Spain could exceed 50 million by 2025, creating a substantial demand for big data analytics tools. Companies are likely to invest in software that can efficiently manage and derive insights from this data, thereby driving growth in the big data-software market.

Government Initiatives and Funding

Government initiatives aimed at fostering digital transformation are playing a crucial role in the growth of the big data-software market in Spain. Various programs and funding opportunities are being introduced to support businesses in adopting advanced technologies. For instance, the Spanish government has allocated €1 billion for digitalization projects, which includes investments in big data solutions. This financial backing is expected to encourage small and medium-sized enterprises (SMEs) to adopt big data software, thereby expanding the market. As these initiatives gain traction, the big data-software market is likely to experience accelerated growth, driven by increased adoption across different sectors.

Increasing Demand for Data Analytics

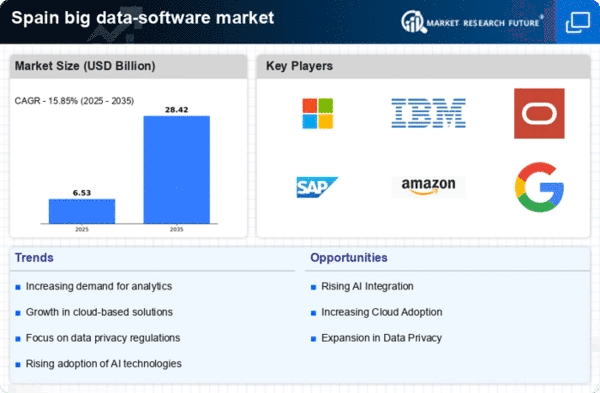

The growing need for data-driven decision-making is propelling the big data-software market in Spain. Organizations across various sectors are increasingly recognizing the value of data analytics in enhancing operational efficiency and customer engagement. According to recent estimates, the data analytics market in Spain is projected to reach €1.5 billion by 2026, reflecting a compound annual growth rate (CAGR) of approximately 12%. This surge is indicative of a broader trend where businesses are leveraging analytics to gain insights into consumer behavior and market trends. Consequently, the demand for sophisticated big data software solutions is likely to rise, as companies seek to harness the power of their data to remain competitive in an evolving marketplace.

Rising Importance of Data-Driven Marketing

The shift towards data-driven marketing strategies is reshaping the landscape of the big data-software market in Spain. Businesses are increasingly utilizing data analytics to tailor their marketing efforts, optimize customer targeting, and enhance campaign effectiveness. This trend is underscored by the fact that companies employing data-driven marketing strategies have reported a 20% increase in ROI on average. As organizations strive to improve their marketing outcomes, the demand for advanced big data software that can analyze consumer data and provide actionable insights is expected to rise. This growing emphasis on data-driven marketing is likely to be a key driver for the big data-software market.

Emergence of Advanced Data Security Solutions

As data breaches and cyber threats become more prevalent, the need for robust data security solutions is increasingly influencing the big data-software market in Spain. Organizations are prioritizing the protection of sensitive information, leading to a surge in demand for software that offers advanced security features. The market for data security solutions is projected to grow at a CAGR of 15% over the next five years, indicating a strong focus on safeguarding data assets. This trend is likely to drive investments in big data software that integrates security measures, ensuring compliance with regulations and protecting against potential threats. The emphasis on data security is expected to be a significant factor in the evolution of the big data-software market.