Rising Demand for Data Analytics

The increasing demand for data analytics in various sectors is a primary driver for the big data-software market. Organizations in China are recognizing the value of data-driven decision-making, leading to a surge in investments in analytics tools. In 2025, the market for data analytics software is projected to reach approximately $10 billion, reflecting a growth rate of around 15% annually. This trend is particularly evident in industries such as finance, healthcare, and retail, where data insights are crucial for competitive advantage. As businesses strive to enhance operational efficiency and customer experience, the big data-software market is likely to expand significantly, driven by the need for sophisticated analytics capabilities.

Emergence of IoT and Smart Devices

The proliferation of Internet of Things (IoT) devices is driving the growth of the big data-software market. In China, the number of connected devices is projected to exceed 1 billion by 2025, generating vast amounts of data that require advanced processing and analysis. This surge in data creation necessitates robust big data solutions to manage, analyze, and derive insights from the information collected. Consequently, companies are increasingly investing in big data-software to harness the potential of IoT data, which is expected to contribute to a market growth rate of approximately 14% annually. The integration of IoT with big data technologies is likely to enhance operational efficiencies and enable smarter decision-making.

Focus on Real-Time Data Processing

The need for real-time data processing is becoming increasingly critical in the big data-software market. Organizations in China are seeking solutions that allow them to analyze data as it is generated, enabling timely decision-making and responsiveness to market changes. This trend is particularly prominent in sectors such as e-commerce and finance, where real-time insights can lead to competitive advantages. The market for real-time data processing solutions is anticipated to grow by 18% in the coming years, driven by the demand for immediate analytics capabilities. As businesses prioritize agility and responsiveness, the big data-software market is likely to benefit from this shift towards real-time data solutions.

Government Initiatives and Support

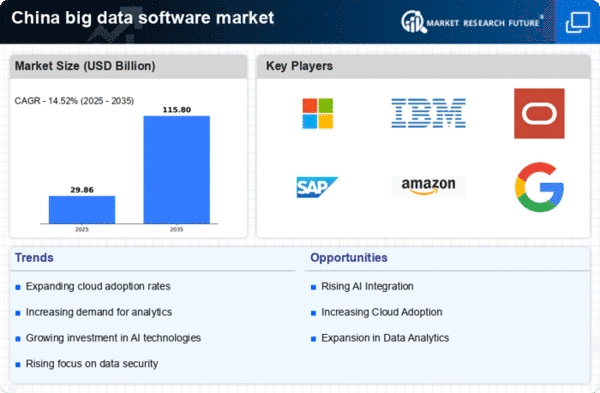

Government initiatives aimed at promoting digital transformation are significantly influencing the big data-software market. In China, the government has launched various programs to encourage the adoption of big data technologies across industries. These initiatives include funding for research and development, tax incentives for tech companies, and the establishment of data centers. As a result, the market is expected to grow at a compound annual growth rate (CAGR) of 12% over the next few years. The government's focus on building a data-driven economy is likely to create a favorable environment for the big data-software market, fostering innovation and attracting investments.

Growing Importance of Data Security

As data breaches and cyber threats become more prevalent, the emphasis on data security is a crucial driver for the big data-software market. In China, organizations are increasingly investing in software solutions that ensure data protection and compliance with regulations. The market for data security software is expected to grow by 20% annually, reflecting the urgent need for robust security measures. Companies are prioritizing the implementation of big data solutions that incorporate advanced security features to safeguard sensitive information. This growing focus on data security is likely to propel the big data-software market, as organizations seek to mitigate risks and protect their data assets.