Increased Data Generation

The exponential growth of data generation across various sectors is a primary driver for the Big Data Software Market. With the proliferation of IoT devices, social media, and digital transactions, organizations are inundated with vast amounts of data. It is estimated that by 2025, the total amount of data created globally will reach 175 zettabytes. This surge necessitates advanced big data solutions to manage, analyze, and derive insights from this data. Companies are increasingly recognizing the need for robust big data software to harness this data effectively, leading to enhanced decision-making and operational efficiency. As a result, the demand for big data software is likely to continue its upward trajectory, reflecting the critical role of data in driving business strategies.

Growing Demand for Real-Time Analytics

The Big Data Software Market is significantly influenced by the rising demand for real-time analytics. Organizations are increasingly seeking immediate insights from their data to make timely decisions. This trend is particularly evident in sectors such as finance, healthcare, and retail, where timely data analysis can lead to competitive advantages. According to recent estimates, the real-time analytics market is projected to grow at a compound annual growth rate of over 30% through 2025. As businesses strive to enhance customer experiences and operational efficiencies, the need for big data software that can process and analyze data in real-time becomes paramount. This demand is likely to drive innovation and investment in big data technologies, further propelling the market forward.

Regulatory Compliance and Data Governance

The increasing emphasis on regulatory compliance and data governance is shaping the Big Data Software Market. Organizations are required to adhere to stringent data protection regulations, such as GDPR and CCPA, which mandate the responsible handling of data. This regulatory landscape compels businesses to invest in big data software that ensures compliance and enhances data governance practices. The market for data governance solutions is projected to grow significantly, reflecting the critical need for organizations to manage their data responsibly. As companies navigate the complexities of compliance, the demand for big data software that facilitates data governance is likely to increase, driving market growth and innovation.

Emergence of Advanced Analytics Techniques

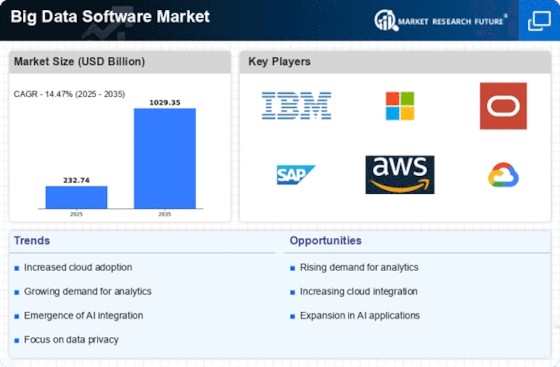

The adoption of advanced analytics techniques, including predictive and prescriptive analytics, is a significant driver for the Big Data Software Market. Organizations are increasingly leveraging these techniques to gain deeper insights and forecast future trends. The Big Data Software Market is expected to reach approximately 150 billion dollars by 2025, indicating a robust growth trajectory. This growth is fueled by the need for businesses to stay ahead of the competition and make data-driven decisions. As companies recognize the value of big data software in implementing these advanced analytics techniques, the demand for sophisticated solutions is likely to rise. This trend underscores the importance of big data software in enabling organizations to unlock the full potential of their data.

Rising Investment in Data-Driven Technologies

The surge in investment in data-driven technologies is a key driver for the Big Data Software Market. Organizations are increasingly allocating resources towards big data initiatives to leverage data for strategic advantage. It is estimated that spending on big data technologies will exceed 200 billion dollars by 2025, highlighting the growing recognition of data as a valuable asset. This investment trend is fueled by the desire to enhance operational efficiencies, improve customer experiences, and drive innovation. As businesses continue to prioritize data-driven strategies, the demand for big data software that supports these initiatives is expected to rise, further propelling the market forward.