Advancements in Technology

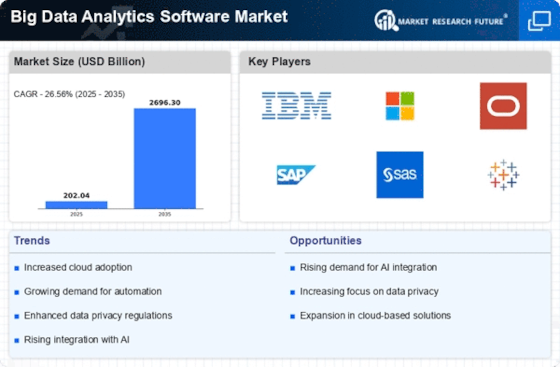

Technological advancements play a crucial role in shaping the Big Data Analytics Software Market. Innovations in cloud computing, artificial intelligence, and machine learning are enabling organizations to process and analyze vast amounts of data more efficiently. The integration of these technologies allows for real-time analytics, which is becoming essential for businesses aiming to respond swiftly to market changes. Furthermore, the proliferation of Internet of Things (IoT) devices generates massive data streams, necessitating advanced analytics solutions. As a result, the market is expected to witness substantial growth, with estimates suggesting that the big data analytics market could exceed 200 billion USD by 2025. This technological evolution is likely to drive demand for analytics software, enhancing the capabilities of the Big Data Analytics Software Market.

Emergence of Predictive Analytics

The emergence of predictive analytics is reshaping the landscape of the Big Data Analytics Software Market. Organizations are increasingly adopting predictive analytics to forecast trends, optimize operations, and enhance decision-making processes. This approach allows businesses to anticipate future outcomes based on historical data, thereby enabling proactive strategies. The market for predictive analytics is projected to grow significantly, with estimates suggesting it could reach around 20 billion USD by 2025. As companies recognize the value of predictive insights in driving business success, the demand for advanced analytics software is likely to escalate. This trend indicates a promising future for the Big Data Analytics Software Market, as organizations seek to harness the power of predictive analytics to gain a competitive edge.

Growing Importance of Customer Insights

The growing importance of customer insights is a significant driver for the Big Data Analytics Software Market. Businesses are increasingly focusing on understanding customer behavior and preferences to tailor their offerings and enhance customer satisfaction. By utilizing big data analytics, organizations can derive actionable insights from customer data, enabling them to create personalized marketing strategies and improve product development. This trend is underscored by Market Research Future indicating that companies leveraging data analytics are likely to achieve a 5-6% increase in customer retention rates. As the demand for customer-centric strategies continues to rise, the Big Data Analytics Software Market is expected to experience robust growth, with projections suggesting a market size of over 250 billion USD by 2025.

Increased Regulatory Compliance Requirements

The rise in regulatory compliance requirements is significantly influencing the Big Data Analytics Software Market. Organizations are increasingly required to adhere to stringent data protection regulations, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). These regulations necessitate the implementation of robust data analytics solutions to ensure compliance and mitigate risks associated with data breaches. As companies invest in analytics tools to monitor and manage compliance, the demand for big data analytics software is expected to surge. This trend is reflected in market forecasts, which indicate that the analytics software market could grow to approximately 150 billion USD by 2025. Consequently, the need for compliance-driven analytics solutions is likely to propel the Big Data Analytics Software Market.

Rising Demand for Data-Driven Decision Making

The increasing emphasis on data-driven decision making is a primary driver for the Big Data Analytics Software Market. Organizations across various sectors are recognizing the value of leveraging data analytics to enhance operational efficiency and improve customer experiences. According to recent estimates, the market for big data analytics is projected to reach approximately 274 billion USD by 2025, reflecting a compound annual growth rate of around 13.2%. This trend indicates that businesses are increasingly investing in analytics solutions to gain insights that inform strategic decisions. As companies strive to remain competitive, the demand for sophisticated analytics tools is likely to grow, thereby propelling the Big Data Analytics Software Market forward.