Health and Wellness Trends

The beverage processing equipment Market is significantly influenced by the growing health and wellness trends among consumers. There is an increasing preference for beverages that are perceived as healthier, such as functional drinks, low-calorie options, and organic products. This shift is prompting manufacturers to adapt their processing techniques and equipment to accommodate new ingredients and formulations. Data indicates that the functional beverage segment is expected to witness a growth rate of around 8% annually, reflecting the rising consumer interest in health-oriented products. Consequently, beverage processors are investing in advanced equipment that can efficiently produce these innovative beverages while ensuring compliance with health regulations. This trend not only drives the demand for specialized processing equipment but also encourages the development of new technologies within the Beverage Processing Equipment Market, fostering a more dynamic and responsive market environment.

Customization and Product Diversification

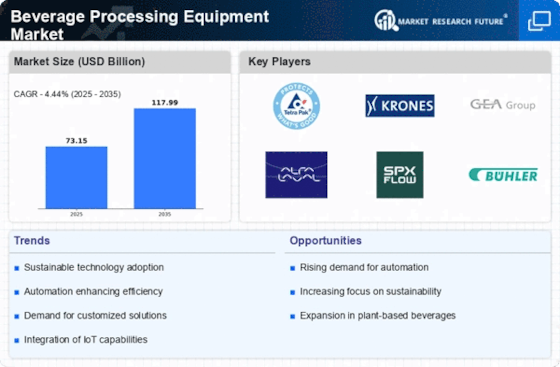

The Beverage Processing Equipment Market is witnessing a trend towards customization and product diversification, driven by evolving consumer preferences. As consumers seek unique flavors and experiences, beverage manufacturers are compelled to innovate and diversify their product offerings. This trend necessitates flexible processing equipment that can accommodate a wide range of formulations and production scales. Data suggests that the demand for customized beverage solutions is expected to grow by around 7% over the next few years. Consequently, manufacturers are investing in versatile processing technologies that allow for rapid changes in production lines and the introduction of new products. This adaptability not only enhances competitiveness but also enables companies to respond swiftly to market trends. Therefore, the emphasis on customization and diversification is a key driver of growth within the Beverage Processing Equipment Market.

Rising Demand for Ready-to-Drink Beverages

The Beverage Processing Equipment Market is experiencing a notable surge in demand for ready-to-drink beverages. This trend is driven by changing consumer lifestyles, where convenience plays a pivotal role. According to recent data, the ready-to-drink segment is projected to grow at a compound annual growth rate of approximately 6% over the next five years. This growth necessitates advanced processing equipment that can efficiently handle diverse formulations and packaging requirements. Manufacturers are increasingly investing in innovative technologies to meet this demand, thereby propelling the Beverage Processing Equipment Market forward. The need for high-speed production lines and versatile machinery is becoming more pronounced, as companies strive to enhance their operational efficiency while maintaining product quality. As a result, the market for beverage processing equipment is likely to expand significantly in response to this evolving consumer preference.

Sustainability and Environmental Regulations

Sustainability has emerged as a critical driver in the Beverage Processing Equipment Market, largely due to increasing environmental regulations and consumer demand for eco-friendly practices. Companies are under pressure to reduce their carbon footprint and implement sustainable production methods. This has led to a rise in the development of energy-efficient equipment and processes that minimize waste and resource consumption. Recent data indicates that the market for sustainable beverage processing technologies is projected to grow by approximately 5% annually. As manufacturers strive to comply with stringent regulations and meet consumer expectations, the demand for innovative, sustainable processing equipment is likely to escalate. This shift not only enhances the environmental profile of beverage companies but also positions them favorably in a market that increasingly values sustainability. Thus, the focus on environmental responsibility is a significant factor driving the Beverage Processing Equipment Market.

Technological Advancements in Processing Equipment

Technological advancements are playing a crucial role in shaping the Beverage Processing Equipment Market. Innovations such as automation, artificial intelligence, and IoT integration are enhancing the efficiency and precision of beverage production processes. For instance, automated systems can significantly reduce labor costs and improve production speed, which is essential in a competitive market. Recent studies suggest that the adoption of smart technologies in beverage processing could lead to a reduction in operational costs by up to 20%. As manufacturers seek to optimize their production lines, the demand for state-of-the-art processing equipment is likely to increase. This trend not only improves productivity but also enables companies to maintain high standards of quality and safety in their products. Therefore, the ongoing technological evolution is expected to be a key driver in the growth of the Beverage Processing Equipment Market.