North America : Flavor Innovation Leader

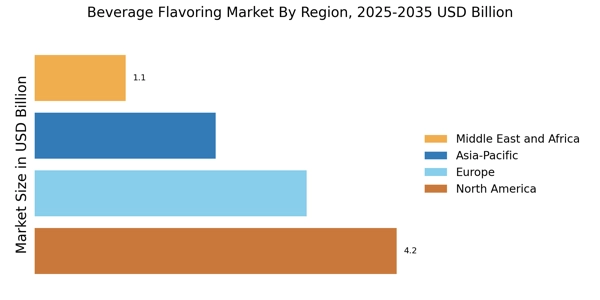

North America is the largest market for beverage flavoring, holding approximately 40% of the global market share. The region's growth is driven by increasing consumer demand for natural and organic flavors, alongside a rise in health-conscious beverage options. Regulatory support for clean label products further fuels this trend, as companies adapt to evolving consumer preferences and stringent food safety regulations.

The United States and Canada are the leading countries in this market, with major players like International Flavors & Fragrances and Sensient Technologies dominating the landscape. The competitive environment is characterized by innovation and strategic partnerships, as companies strive to develop unique flavor profiles that cater to diverse consumer tastes. The presence of established firms ensures a robust supply chain and continuous product development.

Europe : Regulatory Framework Impact

Europe is the second-largest market for beverage flavoring, accounting for around 30% of the global share. The region's growth is propelled by increasing consumer interest in premium and artisanal beverages, alongside stringent regulations that promote transparency in ingredient sourcing. The European Union's regulations on flavoring substances ensure safety and quality, which enhances consumer trust and drives market expansion.

Leading countries in this region include Germany, France, and the United Kingdom, where companies like Givaudan and Symrise are key players. The competitive landscape is marked by innovation in flavor development and a focus on sustainability. European firms are increasingly investing in research and development to create flavors that align with health trends and consumer preferences, ensuring their products remain competitive in a dynamic market.

Asia-Pacific : Emerging Market Potential

Asia-Pacific is witnessing rapid growth in the beverage flavoring market, holding approximately 20% of the global share. The region's expansion is driven by rising disposable incomes, urbanization, and a growing preference for flavored beverages among younger consumers. Additionally, regulatory frameworks are evolving to support innovation while ensuring food safety, which is crucial for market growth.

Key players in this region include T. Hasegawa and Kerry Group, with significant market presence in countries like China, Japan, and India. The competitive landscape is characterized by a mix of local and international firms, all vying to capture the growing demand for unique and culturally relevant flavors. Companies are increasingly focusing on product differentiation and sustainability to appeal to the environmentally conscious consumer base in this dynamic market.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa region is emerging as a significant player in the beverage flavoring market, accounting for about 10% of the global share. The growth is driven by increasing urbanization, a young population, and a rising demand for diverse beverage options. Regulatory bodies are beginning to establish frameworks that support food safety and quality, which is essential for attracting investment in this sector.

Countries like South Africa and the UAE are leading the charge, with local and international companies exploring opportunities in this untapped market. The competitive landscape is evolving, with key players like Mane and Döhler expanding their operations to meet the growing demand. As consumer preferences shift towards innovative and exotic flavors, the region presents significant opportunities for growth and investment in beverage flavoring.