August 2023 saw Leonardo work with Altair, which is a global leader in data analytics and simulation, to assist in the design of a helicopter radar antenna through the use of digital twin technology. From this partnership, it has been possible to develop a digital twin of the structural and electromagnetic systems of the radar antenna. This digital twin enables the Leonardo DRS to monitor the deformations of the radar antenna design and the electrical changes that are induced by the in-flight conditions.

This data can then be applied in making more regions of future antenna systems with maximum efficiency and minimum costs attributable to prototypes.

On Mars 2023, Navarino and Cobham Satcom, a leader in satellite communication (satcom) solutions for the maritime and land mobile sectors, have augmented their strategic cooperation by further integrating Cobham Satcom's next-generation SAILOR XTR antennas into Navarino's global connectivity services.

Thales Group announced the development of a new antenna using metamaterials specifically for spaceborne SAR systems in 2020. The new antenna is said to improve performance compared to conventional antennas significantly.

In 2021, Northrop Grumman was able to reveal a novel phased array antenna suitable for spaceborne SAR systems. As claimed, this new antenna is the smallest and lightest phased array ever created.

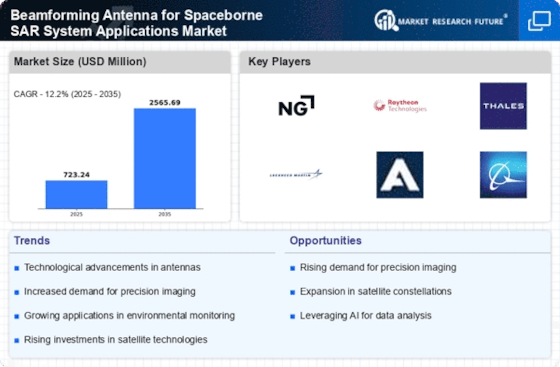

Beamforming Antenna for Spaceborne SAR System Applications Market Key Market Players & Competitive Insights

The Beamforming Antenna for Spaceborne SAR System Applications Market is characterized by the presence of many regional and local vendors. The regional market is highly competitive, with all the players competing to gain a larger market share. The vendors compete based on cost, product quality, reliability, and aftermarket services. Therefore, vendors globally provide cost-effective and efficient products to survive and succeed in a competitive market.

Thales Group., Northrop Grumman, Leonardo S.p.A., Saab AB, B.A.E. Systems., Saab AB, NXP Semiconductors., Thales are the major players in the market, competing in terms of a variety of products for the Beamforming Antenna for Spaceborne SAR System Applications Market and their components, as well as efficiency, reliability, affordability, and advanced technology. The players' primary focus is to provide cutting-edge products to increase adoption, which could help strengthen a country's growth with advanced products. Although global players dominate the market, a few regional and other local players with a limited market share also have a prominent presence.

The major players would look to strengthen their regional presence through mergers & acquisitions of local and global players; they are expected to expand their presence and solutions in these countries during the forecast period. Therefore, manufacturers must develop new technologies to stay on par with emerging technology trends that could affect the competitiveness of their product lines in the market.

Commscope's strategy, called Commscope NEXT, aims to optimize its business portfolio, drive above-market growth, and control costs. A significant part of this strategy is the planned spin-off of its Home Networks business unit to form an independent publicly traded company. This spin-off will allow Commscope and Home Networks to focus on innovation and pursue strategic opportunities to accelerate growth. For Commscope, it reduces complexity and lets focus on providing connectivity solutions that will drive growth in evolving networks. The spin-off also creates a standalone Home Networks company with the flexibility to develop its go-to-market strategy and manufacturing model.

CommScope expects the spin-off and cost reduction measures across its business to offset Home Networks' profit and create savings to reinvest in growth areas.

Saab's key strategy is to focus on innovation and developing new technologies. It invests heavily in research and development, with around 10% of its annual turnover spent on R&D activities. Through continuous innovation, Saab aims to provide its customers with products and solutions with a competitive technological edge. Another important strategy for Saab is international expansion. With over 60% of its sales coming from exports, the company is focused on further penetrating global defense markets. It adopts a partnership-based approach and often collaborates with other prime contractors for opportunities in international programs.

Entering new markets allows Saab to diversify its customer base and reduce dependence on its domestic market.

Thales' main strategic focus is on connectivity and data analytics innovation across its business sectors. The company aims to be a leader in critical information systems by investing heavily in research and development. Its strategy is to develop new technologies in domains such as big data, artificial intelligence, cybersecurity, and quantum computing and apply them to enhance customer solutions. Thales also focuses on partnerships and acquisitions to strengthen its product portfolio and customer base. In recent years, it has made several acquisitions of companies specializing in avionics, cybersecurity, and digital identity.

Additionally, Thales looks to expand its global footprint and capture more market share, especially in growth regions like Asia-Pacific and Latin America.

Key Companies in the Beamforming Antenna for Spaceborne SAR System Applications Market include

- Qualcomm Technologies, Inc.

- Northrop Grumman Corporation.

Beamforming Antenna for Spaceborne SAR System Applications Industry Developments

- In August 2023, Leonardo has partnered with Altair, a global simulation, and data analytics leader, to optimize helicopter radar antenna design using digital twin technology.

- The partnership has resulted in the creation of a digital twin of the radar antenna's structural and electromagnetic systems. This digital twin allows Leonardo DRS to track deformations and electrical changes in the radar antenna's design under in-flight conditions. This information can then be used to optimize the design of future antenna systems without the need for expensive prototypes.

- In March 2023, Navarino and Cobham Satcom, a global leader in satellite communication (satcom) solutions for maritime and land mobile sectors, have further strengthened their strategic partnership through expanded integration of Cobham Satcom's next generation SAILOR XTR antennas with Navarino's global connectivity services.