Advancements in 5G Technology

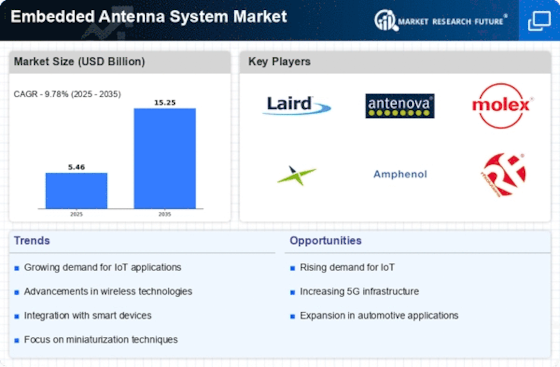

The advent of 5G technology is poised to revolutionize the Embedded Antenna System Market. With its promise of ultra-fast data transfer rates and low latency, 5G is expected to create new opportunities for embedded antennas across various applications. The deployment of 5G networks necessitates the integration of advanced antenna systems that can support higher frequencies and increased bandwidth. Market analysts indicate that the 5G infrastructure investment is projected to exceed USD 1 trillion by 2025, which will likely stimulate demand for innovative embedded antenna solutions. As telecommunications companies and device manufacturers race to capitalize on the benefits of 5G, the Embedded Antenna System Market is likely to witness substantial growth, driven by the need for antennas that can effectively operate within this new technological landscape.

Growth of Internet of Things (IoT)

The proliferation of Internet of Things (IoT) devices is significantly influencing the Embedded Antenna System Market. As more devices become interconnected, the demand for compact and efficient embedded antennas is escalating. IoT applications span various sectors, including smart homes, healthcare, and industrial automation, all of which require reliable wireless communication. Recent estimates suggest that the number of connected IoT devices could reach 30 billion by 2030, creating a substantial market for embedded antenna systems. This growth presents opportunities for manufacturers to develop specialized antennas that cater to the unique requirements of IoT applications, such as low power consumption and miniaturization. Consequently, the Embedded Antenna System Market is likely to expand as companies innovate to meet the diverse needs of the burgeoning IoT ecosystem.

Increased Focus on Miniaturization

The trend towards miniaturization is a critical driver for the Embedded Antenna System Market. As consumer electronics and other devices become smaller and more compact, the demand for miniaturized embedded antennas is intensifying. This trend is particularly relevant in the smartphone and wearable technology sectors, where space constraints necessitate the development of smaller, yet highly efficient antennas. Market data indicates that the miniaturization of antennas can lead to a reduction in size by up to 50% without compromising performance. This capability is essential for manufacturers aiming to create sleek and portable devices. As a result, the Embedded Antenna System Market is likely to see increased investment in research and development focused on miniaturized antenna solutions that meet the demands of modern technology.

Regulatory Compliance and Standards

The Embedded Antenna System Market is also influenced by the need for compliance with regulatory standards and certifications. As wireless communication technologies evolve, regulatory bodies are establishing guidelines to ensure safety, performance, and interoperability. Manufacturers must navigate these regulations to bring their products to market successfully. Compliance with standards such as those set by the Federal Communications Commission (FCC) and the Institute of Electrical and Electronics Engineers (IEEE) is crucial for gaining market access. This regulatory landscape can drive innovation within the Embedded Antenna System Market, as companies strive to develop antennas that not only meet but exceed these standards. Consequently, the focus on regulatory compliance is likely to shape product development strategies and influence market dynamics in the coming years.

Rising Demand for Wireless Communication

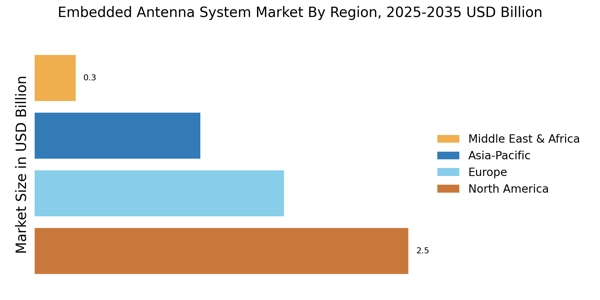

The Embedded Antenna System Market is experiencing a notable surge in demand for wireless communication technologies. As industries increasingly adopt wireless solutions for connectivity, the need for efficient embedded antennas becomes paramount. This trend is particularly evident in sectors such as telecommunications, automotive, and consumer electronics, where seamless connectivity is essential. According to recent data, the wireless communication market is projected to grow at a compound annual growth rate (CAGR) of approximately 15% over the next five years. This growth is likely to drive innovations in embedded antenna systems, as manufacturers strive to meet the evolving requirements for higher data rates and improved signal quality. Consequently, the Embedded Antenna System Market is positioned to benefit significantly from this rising demand, as companies seek to enhance their product offerings with advanced antenna solutions.