Expansion of 5G Networks

The ongoing expansion of 5G networks is a pivotal driver for the Indoor Distributed Antenna System Market. As telecommunications providers roll out 5G infrastructure, the demand for enhanced indoor coverage becomes increasingly critical. 5G technology promises significantly higher data speeds and lower latency, which necessitates the deployment of advanced antenna systems to ensure optimal performance in indoor environments. The transition to 5G is expected to create new opportunities for the Indoor Distributed Antenna System Market, as businesses and service providers seek to upgrade their existing infrastructure to accommodate the demands of next-generation wireless technology. This shift not only enhances user experience but also supports the growing number of connected devices, further solidifying the role of distributed antenna systems in modern telecommunications.

Growing Mobile Data Traffic

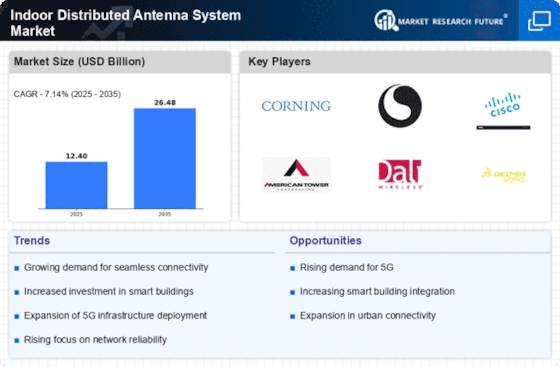

The Indoor Distributed Antenna System Market is experiencing a surge in demand due to the increasing mobile data traffic. With the proliferation of smartphones and IoT devices, data consumption is projected to rise significantly. According to recent estimates, mobile data traffic is expected to grow at a compound annual growth rate of over 25% in the coming years. This trend necessitates robust indoor connectivity solutions, as traditional cellular networks often struggle to provide adequate coverage in densely populated areas. Consequently, businesses and organizations are investing in indoor distributed antenna systems to ensure seamless connectivity and enhance user experience. This growing reliance on mobile data is a key driver for the Indoor Distributed Antenna System Market, as it compels stakeholders to adopt advanced technologies that can support high data throughput and reliable service.

Increased Focus on Network Reliability

In the context of the Indoor Distributed Antenna System Market, the emphasis on network reliability is becoming increasingly pronounced. Organizations across various sectors are recognizing the critical need for uninterrupted connectivity, particularly in environments such as hospitals, airports, and corporate offices. The demand for reliable communication systems is driving investments in distributed antenna systems, which can mitigate signal loss and enhance coverage. As businesses strive to maintain operational efficiency, the ability to provide consistent and high-quality network service is paramount. This focus on reliability is further supported by the growing trend of remote work and digital transformation initiatives, which require dependable connectivity solutions. As a result, the Indoor Distributed Antenna System Market is likely to witness sustained growth as organizations prioritize network reliability to meet their operational needs.

Rising Adoption of Smart Building Technologies

The Indoor Distributed Antenna System Market is witnessing a notable increase in the adoption of smart building technologies. As organizations seek to enhance operational efficiency and improve user experiences, the integration of smart systems is becoming a priority. Indoor distributed antenna systems play a crucial role in supporting these technologies by providing the necessary connectivity for IoT devices, sensors, and automation systems. The trend towards smart buildings is expected to drive demand for advanced communication solutions, as seamless connectivity is essential for the effective functioning of smart technologies. Furthermore, the growing emphasis on energy efficiency and sustainability in building design is likely to further propel the Indoor Distributed Antenna System Market, as stakeholders recognize the value of integrated communication systems in achieving these objectives.

Regulatory Support for Telecommunications Infrastructure

The Indoor Distributed Antenna System Market is benefiting from favorable regulatory frameworks that promote the development of telecommunications infrastructure. Governments and regulatory bodies are increasingly recognizing the importance of robust communication networks for economic growth and public safety. Initiatives aimed at enhancing wireless coverage in urban and rural areas are encouraging investments in distributed antenna systems. For instance, policies that facilitate the deployment of small cells and other infrastructure improvements are likely to create a conducive environment for market expansion. This regulatory support not only fosters innovation but also attracts investments from telecommunications companies seeking to enhance their service offerings. As a result, the Indoor Distributed Antenna System Market is poised for growth, driven by the alignment of regulatory policies with the need for advanced communication solutions.